AI Economy Unveiled: 5 Key Differences from the 1990s Tech Boom

Explore the AI economy's unique trajectory compared to the 1990s tech boom, highlighting key differences and potential risks.

Why the AI Economy Might Not Be a 1990s Redux: An In-Depth Analysis

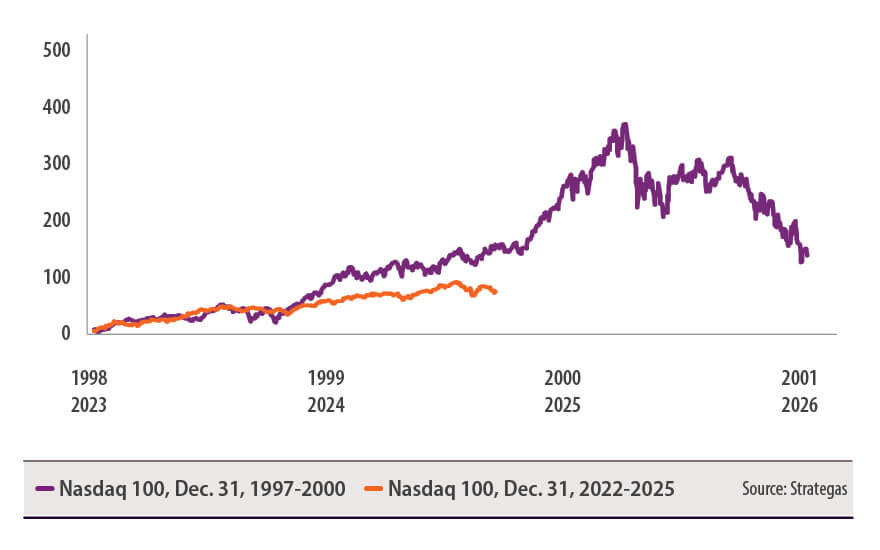

The current surge in artificial intelligence (AI) investments and technological breakthroughs has sparked comparisons to the 1990s tech boom, raising questions about whether the AI-driven economy is simply a repeat of that era or something fundamentally different. While AI is undoubtedly transforming markets and lifting stock valuations, experts and analysts caution that the dynamics and broader economic context today indicate a more complex and potentially less volatile trajectory than the dot-com bubble of the late 20th century.

The AI Boom: Dominating the Market but Masking Challenges

In 2025, AI companies have accounted for approximately 80% of the gains in U.S. stock markets, propelling equities to record highs and attracting an unprecedented influx of foreign capital. In the second quarter alone, foreign investors poured a record $290 billion into U.S. stocks, now owning about 30% of the market, the highest since World War II. This influx has created what some describe as an "AI bubble," with stock prices highly disconnected from traditional valuation metrics. The market capitalization to GDP ratio, known as the Buffett Indicator, has surged to 217%, well above its long-term average and signaling elevated risk.

However, this AI-driven optimism coexists with underlying economic weaknesses such as persistent inflation, rising debt levels, and geopolitical uncertainties. While stock markets thrive on AI hype, broader economic indicators suggest slower growth and challenges in other sectors, raising concerns that the AI boom might be propping up an otherwise fragile economy.

Key Differences from the 1990s Tech Bubble

Despite surface-level similarities to the 1990s dot-com boom, several critical differences suggest the AI economy may not follow the same boom-and-bust pattern:

-

Broader Industry Impact: Unlike the dot-com era, where many internet companies lacked clear business models, today's AI applications have tangible productivity gains across multiple industries, from healthcare to manufacturing.

-

Labor Market Stability: Early fears of massive job displacement due to AI have not yet materialized on a large scale. Recent studies indicate that while AI is changing occupational mixes, the overall labor market remains stable without widespread unemployment spikes attributable to automation. This contrasts with the 1990s, when technological disruption led to significant shifts but also created many new job categories.

-

Investment and Growth Patterns: Current business investment in AI and related technologies continues to rise, albeit at a slower pace. This sustained investment contrasts with the late 1990s, where exuberance fueled speculative investments in companies with little revenue, eventually leading to a market crash.

-

Global Capital Flows: The scale of foreign investment in U.S. AI-driven stocks is unprecedented, reflecting global confidence in American leadership in AI. This international dimension of capital inflows was less pronounced in the 1990s and adds a layer of complexity to market dynamics.

Economic and Productivity Implications of AI

AI technologies are poised to enhance productivity and GDP growth in ways not fully realized during previous tech waves. According to experts at the Wharton School, AI's integration into business processes can lead to substantial efficiency improvements, innovation acceleration, and new product development. These improvements may translate into more sustainable economic growth if leveraged effectively.

However, the scale of AI’s impact depends on several factors including regulatory frameworks, workforce adaptation, and corporate investment strategies. Effective management of these elements will be critical to converting AI’s potential into broad economic benefits rather than speculative stock market gains.

Cautionary Perspectives and Potential Risks

Some analysts warn of the possibility that the AI economy is forming a bubble even larger than past ones. The valuation ratios related to AI stocks are reportedly 17 times larger than the dot-com bubble at its peak and four times the size of the subprime mortgage bubble of 2007. Such elevated valuations increase the risk of a sharp market correction should AI hype fail to meet economic realities.

Moreover, the concentration of market gains in a few large AI companies raises concerns about market fragility and inequality in investment returns. The broader economic benefits of AI may take longer to materialize, and sectors not directly related to AI continue to face headwinds, suggesting uneven economic growth.

Visuals to Illustrate the AI Economy

- Stock Market Graphs showing the rise in AI company valuations and the Buffett Indicator reaching record highs.

- Infographics depicting foreign investment flows into U.S. equities and the share owned by international investors.

- Labor Market Charts reflecting occupational changes and employment stability despite AI adoption.

- Images of Key AI Technologies such as generative AI interfaces, AI-powered robotics in manufacturing, or AI applications in healthcare diagnostics.

- Portraits of Key Figures in AI investment and policy who influence the market and regulatory landscape.

Context and Outlook

The AI-driven economic surge represents both an opportunity and a challenge. It is not simply a rerun of the 1990s tech boom but a more nuanced phenomenon with deeper integration into the economy and a larger global dimension. While AI's transformative potential is vast, careful monitoring of market valuations, economic fundamentals, and labor impacts remains crucial.

Investors, policymakers, and businesses must navigate the fine line between harnessing AI for sustainable growth and avoiding the pitfalls of speculative excess. The coming years will be decisive in determining whether AI becomes a foundational pillar of a new economy or another chapter in a cyclical pattern of boom and bust.