AI Stocks Lead Wall Street to Fourth Consecutive Loss

AI stocks lead Wall Street to its fourth consecutive loss amid bubble fears, with major indices dropping sharply on December 17, 2025.

AI Stocks Plunge, Dragging Wall Street into Fourth Consecutive Loss Amid Bubble Fears

Wall Street closed lower on Wednesday, December 17, 2025, marking its fourth straight daily loss as sharp declines in AI stocks led the selloff. The Nasdaq composite dropped 1.8% and the S&P 500 fell 1.2%, its worst day in nearly a month. Major indices ended the session with the S&P 500 at 6,721.43 (down 78.83 points), the Dow Jones Industrial Average at 47,885.97 (down 228.29 points), and the Nasdaq at 22,693.32 (down 418.14 points), driven by doubts over AI investments' profitability and rising debt concerns among tech giants.

Market Performance and Key Decliners

The downturn accelerated in the afternoon, erasing early gains as investors rotated away from high-flying AI leaders. Oracle (ORCL) spearheaded the Nasdaq's slide, contributing significantly to the index's losses alongside other tech heavyweights. Power utilities, which had surged earlier in 2025 on expectations of booming demand from AI data centers, also faltered: Constellation Energy tumbled 6.7%.

Broader market dynamics showed slightly more S&P 500 stocks advancing than declining, but megacap AI names overwhelmed the positives. Media stocks like Warner Bros. Discovery (-2.4%) and Paramount Skydance (-5.4%) added to the pressure. Despite the pullback, the S&P 500 remains near its all-time high from the prior week, underscoring the market's resilience amid volatility.

Analysts point to profit-taking after a stellar run for AI equities. For context, top performers as of December 15, 2025, included Seagate Technology Holdings (STX) with a 188.98% one-year gain, Palantir Technologies (PLTR) up 154.18%, Micron Technology (MU) up 132.83%, Symbotic (SYM) up 124.85%, and NVIDIA (NVDA) up 101.69%. These gains fueled the rally but now invite questions about sustainability.

Visual: A line chart from financial news outlets depicting the Nasdaq's 1.8% intraday plunge on December 17, 2025, highlighting drops in Oracle and other AI leaders, overlaid with S&P 500 trends.

Underlying Concerns: AI Hype Meets Reality

Investors are increasingly skeptical about whether massive AI spending will deliver commensurate returns. Questions swirl around whether years of dominance by AI "superstars" inflated valuations beyond fundamentals, with debt accumulation for infrastructure raising red flags. A UBS survey of large businesses revealed only 17% are scaling AI projects to production levels, signaling tempered 2026 revenue growth expectations despite rising adoption rates.

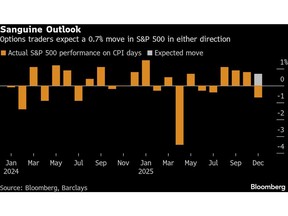

This echoes broader narratives of a potential AI bubble deflating in a "healthy" manner, as described in market commentary. Global selloffs signal profit realization rather than panic, with some viewing it as a correction after explosive gains. Macro factors, including liquidity stress and upcoming economic data releases, add uncertainty—potentially amplifying surprises in jobs or inflation reports.

In a December 15, 2025, analysis, experts noted persistent "stress related to this AI tech buildup story," with rebounds in underlying liquidity indicators but fading optimism in futures trading. Seasonally, December positivity has played out early, leaving room for a potential Santa Claus rally through year-end, bolstered by extra U.S. trading days around Christmas.

Visual: Bar graph illustrating Oracle's leading role in the Nasdaq decline, with percentage drops for top AI stocks like NVIDIA and Palantir on December 17.

Broader Context and Sector Shifts

The AI frenzy propelled markets in 2025, with data center power demands boosting utilities and hardware firms like Seagate and Micron thriving on storage and memory needs for AI models. Palantir and Symbotic exemplify software and robotics applications, serving clients like Walmart and Target. Yet, as adoption lags at scale, investors pivot toward diversified exposure via AI-focused ETFs, ideal for long-term holders avoiding single-stock risks.

Global markets showed mixed signals: London's FTSE jumped amid oil and gold advances tied to Venezuela developments, contrasting U.S. tech woes. This rotation underscores a flight from overvalued AI to value sectors.

Implications for Investors and 2026 Outlook

The selloff serves as a reality check, tempering exuberance after AI's transformative 2025 run. While top stocks like NVIDIA retain "buy" ratings with upside targets, "hold" consensus on others like Palantir reflects caution. UBS analysts urge sobriety on near-term uplifts, predicting gradual scaling.

For investors, opportunities emerge in dips: Seagate's "buy" rating and Micron's "strong buy" suggest resilience in AI infrastructure. Macro voices highlight liquidity rebounds as a positive undercurrent, with potential for year-end positivity if data surprises favorably. However, persistent doubts on productivity gains from AI could prolong volatility.

This correction may ultimately strengthen the sector by weeding out hype, fostering sustainable growth. Wall Street's near-record levels affirm underlying strength, but discerning AI's true value proposition remains key heading into 2026.