Alphabet Stock Reaches Record Heights as Google Enters AI Chip Competition Against Nvidia

Alphabet's shares have climbed to unprecedented levels as the tech giant aggressively pursues its own artificial intelligence chip development, directly challenging Nvidia's dominance in the semiconductor market.

Alphabet's Stock Surge Reflects Growing AI Ambitions

Alphabet's share price has reached all-time highs, signaling investor confidence in the company's strategic pivot toward developing proprietary artificial intelligence chips. This milestone comes as Google intensifies its competition with Nvidia, the current market leader in AI semiconductors, marking a significant shift in the competitive landscape of the technology sector.

The stock rally reflects broader market recognition that Alphabet is no longer content relying solely on third-party chip manufacturers. By investing heavily in custom silicon development, the company is positioning itself to reduce costs, improve performance, and maintain greater control over its AI infrastructure—critical advantages in an industry where computational power directly translates to competitive advantage.

Strategic Chip Development and Market Implications

Google's in-house chip initiatives, including its Tensor Processing Units (TPUs), represent a fundamental strategy to compete with Nvidia's GPUs. Unlike Nvidia, which sells chips to multiple customers, Alphabet can optimize its silicon specifically for its own AI workloads, potentially achieving superior efficiency and performance metrics.

Key competitive advantages of this approach:

- Cost reduction: Developing proprietary chips allows Alphabet to lower the per-unit cost of AI infrastructure

- Performance optimization: Custom silicon can be tailored to Google's specific machine learning algorithms and services

- Supply chain independence: Reduces reliance on external suppliers and mitigates semiconductor shortage risks

- Margin improvement: Higher-margin chip production could significantly boost profitability

The move also reflects the broader industry trend where major technology companies are vertically integrating their hardware and software stacks. Meta, Apple, and Amazon have similarly invested in custom silicon, recognizing that off-the-shelf solutions may not meet their specialized requirements.

Market Context and Investor Sentiment

Alphabet's record stock performance demonstrates investor appetite for companies positioned at the intersection of artificial intelligence and semiconductor innovation. The valuation surge suggests markets are pricing in the long-term benefits of reduced infrastructure costs and improved operational efficiency.

However, competing directly with Nvidia presents significant challenges. Nvidia has established deep relationships with data center operators, extensive software ecosystem support through CUDA, and years of optimization experience. Alphabet's success will depend on demonstrating that its chips deliver measurable advantages in real-world AI applications.

Financial and Operational Outlook

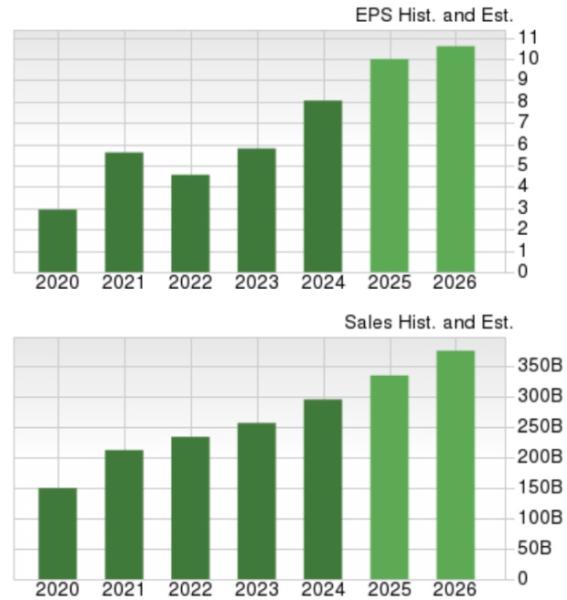

The stock's ascent also reflects confidence in Alphabet's core business resilience. Despite regulatory scrutiny and competitive pressures in search and advertising, the company continues generating substantial cash flows that fund ambitious R&D initiatives. This financial flexibility allows Alphabet to pursue long-term strategic bets like chip development without compromising near-term profitability.

Investors are particularly focused on whether custom chips will meaningfully improve margins in Alphabet's cloud division, Google Cloud, which competes with Amazon Web Services and Microsoft Azure. AI-optimized infrastructure could become a key differentiator in attracting enterprise customers.

Looking Ahead

Alphabet's record stock price reflects a market conviction that the company's AI chip strategy represents a sound long-term investment. As the artificial intelligence market continues expanding, companies that control their computational infrastructure may enjoy structural advantages over those dependent on external suppliers.

The competitive dynamic between Alphabet and Nvidia will likely intensify, with broader implications for the entire semiconductor and cloud computing industries. Investors should monitor quarterly earnings reports for metrics on chip deployment, cloud revenue growth, and capital expenditure trends to assess whether the stock's valuation premium is justified by operational results.

Key Sources

- Alphabet investor relations and quarterly earnings reports

- Industry analysis on AI chip development strategies

- Market research on semiconductor competition and cloud infrastructure trends