AMD Stock Slides as AI Infrastructure Headwinds Intensify

AMD's share price faces pressure as market concerns about AI infrastructure costs, power consumption, and competitive dynamics weigh on investor sentiment. The chipmaker's ambitious AI accelerator roadmap faces scrutiny amid broader industry challenges.

AMD Stock Slides as AI Infrastructure Headwinds Intensify

AMD's stock price has come under significant pressure as investors grapple with mounting concerns about the sustainability and profitability of the AI infrastructure buildout. The semiconductor manufacturer, which has positioned itself as a key player in the generative AI acceleration market, now faces headwinds from multiple directions—rising power consumption costs, competitive pressures from NVIDIA, and questions about data center spending cycles.

The Power Consumption Challenge

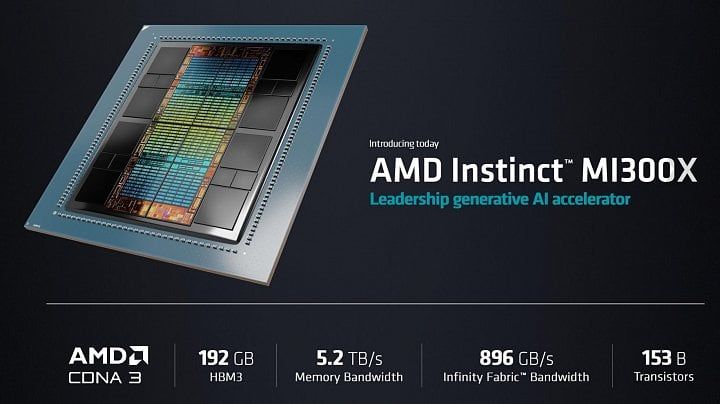

One of the most pressing concerns for AMD's data center business centers on the power requirements of its flagship AI accelerators. The MI300X, AMD's latest-generation GPU designed for large language model training and inference, carries a thermal design power (TDP) rating of 750 watts per unit. This substantial power draw translates directly into operational costs for data center operators, raising questions about the total cost of ownership compared to competing solutions.

As hyperscalers and enterprise customers evaluate their AI infrastructure investments, power efficiency has become a critical decision factor. The escalating electricity costs associated with AI workloads are forcing customers to reconsider deployment strategies and accelerator choices. This dynamic has created uncertainty around AMD's near-term revenue trajectory in the data center segment.

Market Dynamics and Competitive Pressure

AMD's challenges extend beyond hardware specifications. The company continues to face intense competition from NVIDIA, which maintains a commanding market share in AI accelerators. While AMD has made technical strides with its MI300 series, converting design wins into sustained revenue growth remains difficult in a market where customer lock-in and software ecosystem advantages heavily favor the incumbent.

Additionally, the broader AI infrastructure market is showing signs of maturation. After years of explosive growth, some analysts question whether the pace of data center spending on AI accelerators can be sustained at current levels. This uncertainty has rippled through semiconductor stocks more broadly, with AMD bearing particular vulnerability given its exposure to the data center segment.

Strategic Implications

The stock decline reflects deeper concerns about AMD's ability to execute on its ambitious AI roadmap while maintaining competitive pricing and power efficiency. The company's success depends on:

- Accelerating software ecosystem development to reduce the switching costs for customers currently invested in NVIDIA's CUDA platform

- Improving power efficiency metrics in future GPU generations to address operational cost concerns

- Securing major design wins with hyperscalers to demonstrate sustained demand for MI-series accelerators

- Managing gross margins amid potential pricing pressure in a more competitive market

Investor Sentiment and Outlook

The stock pressure reflects a broader reassessment of AI infrastructure valuations. After a period of euphoric sentiment around generative AI spending, investors are now applying more rigorous scrutiny to unit economics and return on investment calculations. For AMD, this shift in sentiment has exposed vulnerabilities in its market positioning relative to more diversified competitors.

The path forward requires AMD to demonstrate that its MI300 series and future accelerators can achieve meaningful market penetration while maintaining healthy margins. Quarterly earnings reports and customer commentary will be closely watched for evidence that the company can convert its technical capabilities into sustainable business growth.

Key Sources

- AMD Instinct MI300X specifications and power consumption data

- Industry analysis on AI infrastructure spending trends and competitive dynamics

- Market commentary on semiconductor valuations and data center spending cycles

Technical Note: Power consumption figures and product specifications reflect publicly available AMD documentation. Market analysis based on industry reporting and investor commentary.