Beijing's H200 Freeze: China's Gambit to Pressure Nvidia While Building Homegrown AI Chips

China has instructed its tech companies to halt purchases of Nvidia's H200 chips, signaling a strategic shift in the semiconductor standoff between Beijing and Washington. The move reflects deeper tensions over AI chip access and domestic chip development.

The Pressure Play

The semiconductor battlefield just shifted. According to reporting from Tom's Hardware, Beijing has instructed Chinese tech companies to pause purchases of Nvidia's H200 chips, marking an escalation in the ongoing tech cold war between the U.S. and China. The directive doesn't represent an outright ban—instead, it's a calculated pause while Beijing deliberates its negotiating position with Washington over future chip sales terms.

This move exposes a critical vulnerability in Nvidia's business model: dependence on Chinese demand. The H200, Nvidia's latest high-bandwidth GPU designed for AI inference and data center workloads, has become a focal point in geopolitical negotiations. By instructing companies to hold off purchases, China is signaling it won't be a passive consumer of American semiconductor dominance.

Why the H200 Matters

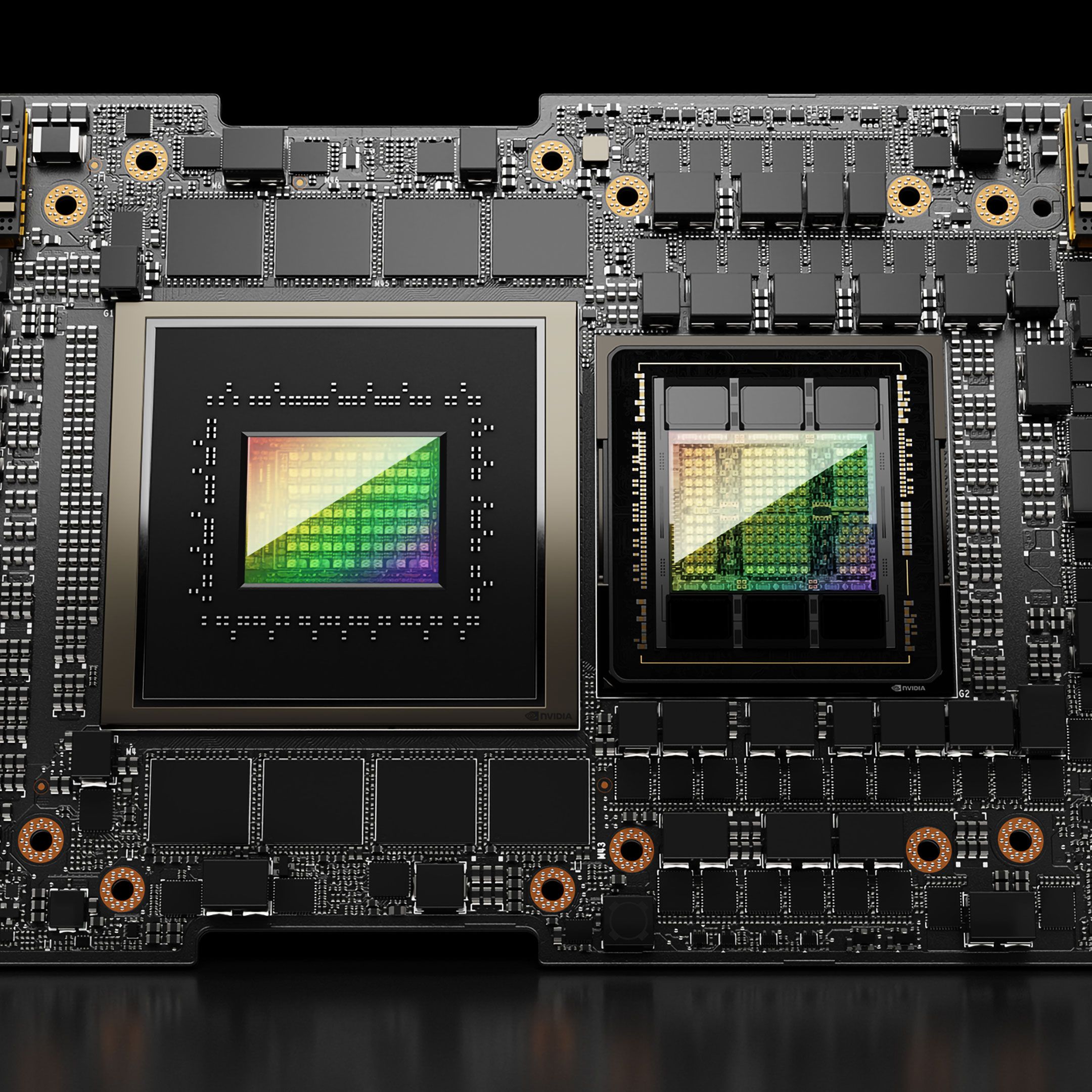

The H200 represents a significant leap in AI infrastructure. With 141GB of HBM3e memory and 4.8 TB/s bandwidth, it's engineered for the kind of large-language-model inference that powers modern AI applications. For Chinese tech giants—companies like Alibaba, Baidu, and Tencent—access to this hardware has been critical for competing in the global AI race.

However, U.S. export controls have already constrained what China can legally purchase. The H200 sits in a gray zone: not explicitly banned under current regulations, but subject to scrutiny. Beijing's pause suggests the government is using this ambiguity as leverage.

The Deeper Strategic Context

China's instruction reflects a two-pronged strategy:

-

Domestic chip development: Beijing is doubling down on homegrown alternatives. According to the Council on Foreign Relations, China faces a significant AI chip deficit, and Huawei has struggled to catch up to Nvidia despite years of development. The pause buys time for companies like Huawei to advance their own GPU offerings.

-

Negotiating leverage: By halting purchases voluntarily, China demonstrates it can control demand—a tool to extract concessions from Washington on future export policies.

The U.S. Response Question

The pause also highlights ongoing debate within U.S. policy circles. Some analysts argue that allowing Nvidia to sell H200 chips to China would be a strategic mistake, as it would strengthen Chinese AI capabilities at a time when the U.S. seeks technological superiority. Others contend that restricting sales only accelerates China's independent chip development.

What's at Stake

For Nvidia, this pause threatens near-term revenue from one of its largest markets. Chinese data center operators represent a meaningful portion of the company's addressable market. A prolonged freeze could force Nvidia to redirect inventory and adjust financial guidance.

For China, the calculus is more complex. Pausing H200 purchases demonstrates resolve but also delays AI infrastructure upgrades that Chinese companies need to compete globally. The government is betting that Washington will eventually negotiate—offering some H200 access in exchange for other concessions.

The Broader Implication

This episode underscores a fundamental shift in semiconductor geopolitics: chips are no longer just products; they're strategic assets. The H200 freeze isn't really about one GPU model—it's about who controls the infrastructure for artificial intelligence in the coming decade.

The pause likely won't last indefinitely. But it signals that both sides are willing to use supply chains as negotiating tools, with no clear resolution in sight.