Blackstone Warns: 5 AI Disruptions Wall Street Can't Ignore (2023 Analysis)

Blackstone warns Wall Street about underestimating AI's transformative impact on finance, urging proactive strategies to avoid competitive disadvantages.

Blackstone Warns of Wall Street’s Complacency on AI Disruption

Blackstone, one of the world’s largest alternative asset managers, has issued a stark warning that Wall Street is underestimating the transformative impact of artificial intelligence (AI) on financial markets and investment strategies. According to a recent statement highlighted by the Financial Times, Blackstone executives believe that many firms on Wall Street are complacent about the scale and speed at which AI technologies will disrupt traditional financial services.

AI’s Rising Influence in Finance

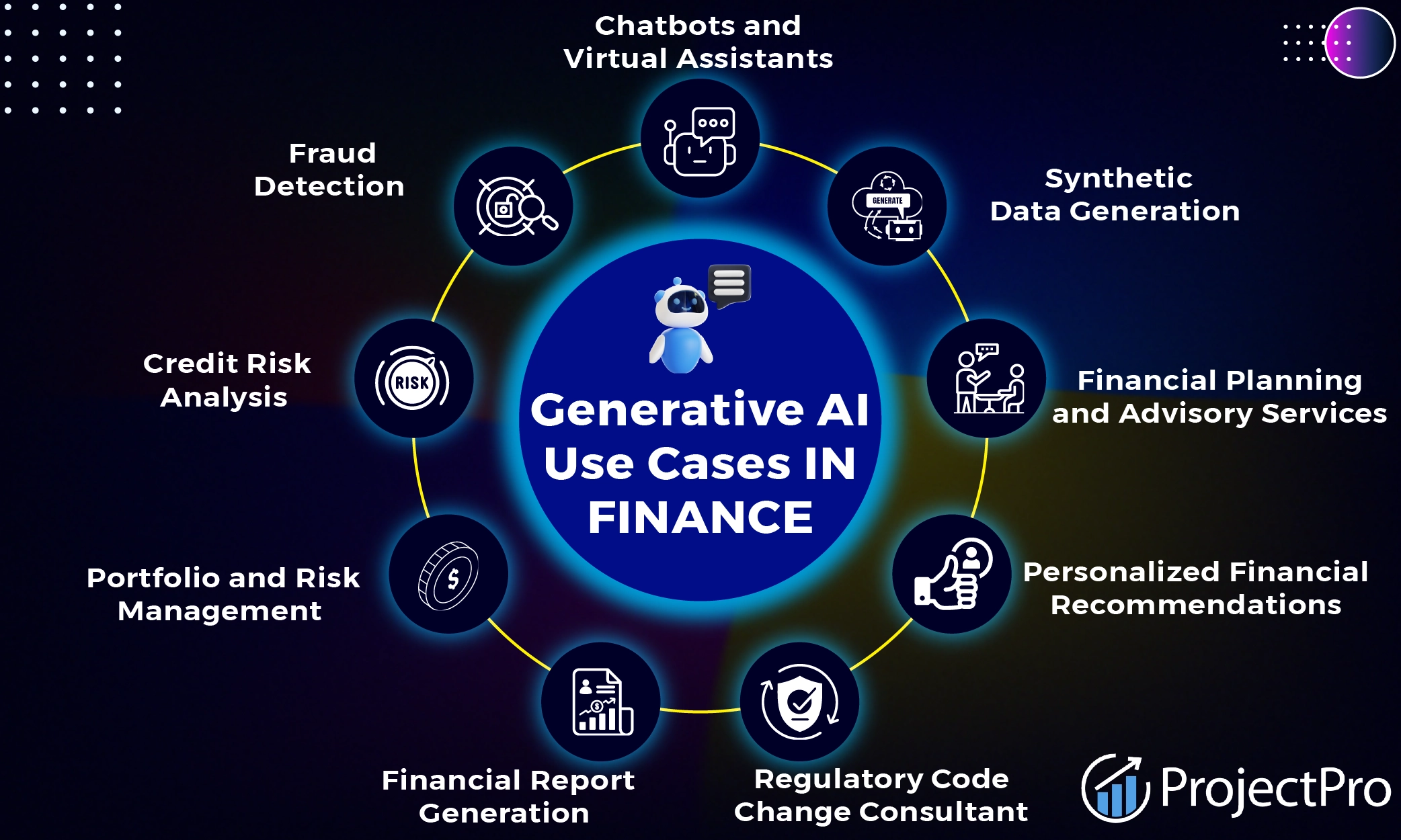

AI technologies, including large language models, machine learning algorithms, and automation tools, are increasingly reshaping how financial institutions operate. From algorithmic trading and portfolio management to risk assessment and customer service, AI-driven solutions are enabling faster, more accurate decision-making and cost efficiencies. Despite this, Blackstone suggests that a significant portion of Wall Street has not yet fully embraced or prepared for the breadth of change AI promises.

Blackstone’s Perspective on Market Readiness

Blackstone’s leadership, known for its strategic insight into market trends, argues that the financial sector’s current approach to AI is reactive rather than proactive. This complacency could lead to missed opportunities or competitive disadvantages. The firm emphasizes the need for:

- Increased investment in AI capabilities to harness data more effectively and generate alpha.

- A strategic shift in talent acquisition, prioritizing AI and data science expertise.

- Enhanced risk management frameworks that account for AI-driven market dynamics and potential systemic risks.

By contrast, Blackstone itself has been actively integrating AI into its investment processes. The firm reportedly uses AI to analyze vast datasets for identifying undervalued assets, optimizing portfolio allocations, and improving predictive analytics.

Why Wall Street’s Complacency is Risky

The financial industry has historically experienced waves of disruption—from electronic trading to fintech innovations. AI’s potential impact rivals or exceeds these past shifts because it can fundamentally alter fundamental investment paradigms. Complacency could lead to:

- Loss of market share to more agile competitors leveraging AI.

- Increased operational risks as AI systems become embedded but not fully understood or monitored.

- Regulatory challenges, as authorities may impose new rules on AI usage after firms have already scaled their AI deployments.

Experts agree that AI will not only automate routine tasks but also enhance complex decision-making processes that were traditionally human-driven, such as credit underwriting or fraud detection.

Industry Reactions and Broader Context

Other leading financial firms have acknowledged AI’s potential but differ on the timeline and extent of disruption. While some hedge funds and banks have made substantial AI investments, many traditional asset managers and brokers are still in exploratory phases.

Blackstone’s warning aligns with broader industry discussions about AI’s dual-edged nature: it offers enormous efficiency and insight gains but also demands significant cultural and technological shifts. The message is clear—financial institutions must accelerate their AI adoption strategies or risk falling behind.

Visual Context: Blackstone and AI

- The Blackstone logo, often associated with strength and innovation, now symbolizes a firm positioning itself at the forefront of AI-driven finance.

- Images of AI-related technologies, such as neural network visualizations, data analytics dashboards, or algorithmic trading screens, help illustrate the transformation underway.

- Executive portraits of Blackstone leaders who have publicly commented on AI provide a human dimension to the firm’s strategic stance.

Conclusion

Blackstone’s candid assessment serves as an urgent call to Wall Street: AI disruption is not a distant threat but an immediate challenge requiring decisive action. By highlighting complacency, Blackstone underscores the need for the financial sector to rethink investment, talent, and risk strategies to thrive in an AI-powered future.