Market Faces Test as AI-Infrastructure Trade Unwinds

Market faces test as AI-infrastructure trade unwinds, with potential re-rating of tech capex and data-center buildouts under scrutiny.

Overview

The market's capacity to handle a shift away from the AI-infrastructure trade is under scrutiny, as highlighted by CNBC market commentator Rick Santoli. The focus is on the potential re-rating of big tech capital expenditures, data-center buildouts, and hardware suppliers.

Background

The AI-infrastructure trade involves investments in companies providing the physical and cloud infrastructure for generative AI. This includes:

- Hyperscale cloud providers

- GPU and accelerator manufacturers

- Data-center landlords (REITs)

- Networking equipment vendors

- Specialized systems integrators

Industry analysts predict a shift from speculative AI software hype towards substantial investments in computing, power, and real estate by 2025–2026.

Santoli's Observations

Santoli points out that the market's concentration in AI-infrastructure could lead to rapid unwinding if demand slows or earnings disappoint. The market's ability to absorb a large reallocation away from these names without significant declines is uncertain.

Recent Signs and Data Points

- Cloud providers' capital spending remains high, driven by the need to expand AI compute capacity.

- S&P Global Market Intelligence warns of vulnerabilities due to market concentration in AI-dependent tech giants.

- Analysts see data-center real estate and networking as long-term plays but note constraints like supply and power.

Key Companies and Segments

- Hyperscalers: Alphabet/Google Cloud, Microsoft Azure, Amazon Web Services

- Chipmakers and Accelerators: Suppliers of GPUs and AI ASICs

- Data-center REITs and Infrastructure: Owners/operators of physical facilities

- Networking and Optical Companies: Suppliers of high-speed interconnects

Context and Market Implications

The AI-infrastructure trade has been a significant factor in market performance since 2020. A rapid rotation away could reverse concentrated gains, increasing volatility.

Potential Unravel Scenarios

- Demand Softness: Slower AI project deployments could pressure suppliers' order books.

- Execution/Cost Shock: If capex doesn't generate expected revenue growth, markets might reprice returns.

Counterpoint

Many believe AI infrastructure is a multi-year build, absorbing near-term volatility due to high secular demand.

Implications for Investors

- Diversification: Consider broadening exposure beyond hyperscalers.

- Monitor Indicators: Watch hyperscaler capex guidance, server/GPU orders, and data-center metrics.

- Policy and Economics: Interest rates, permitting, and geopolitical factors remain critical.

Visuals and Assets

- Logos and images of major hyperscalers

- Photos of data centers and GPU hardware

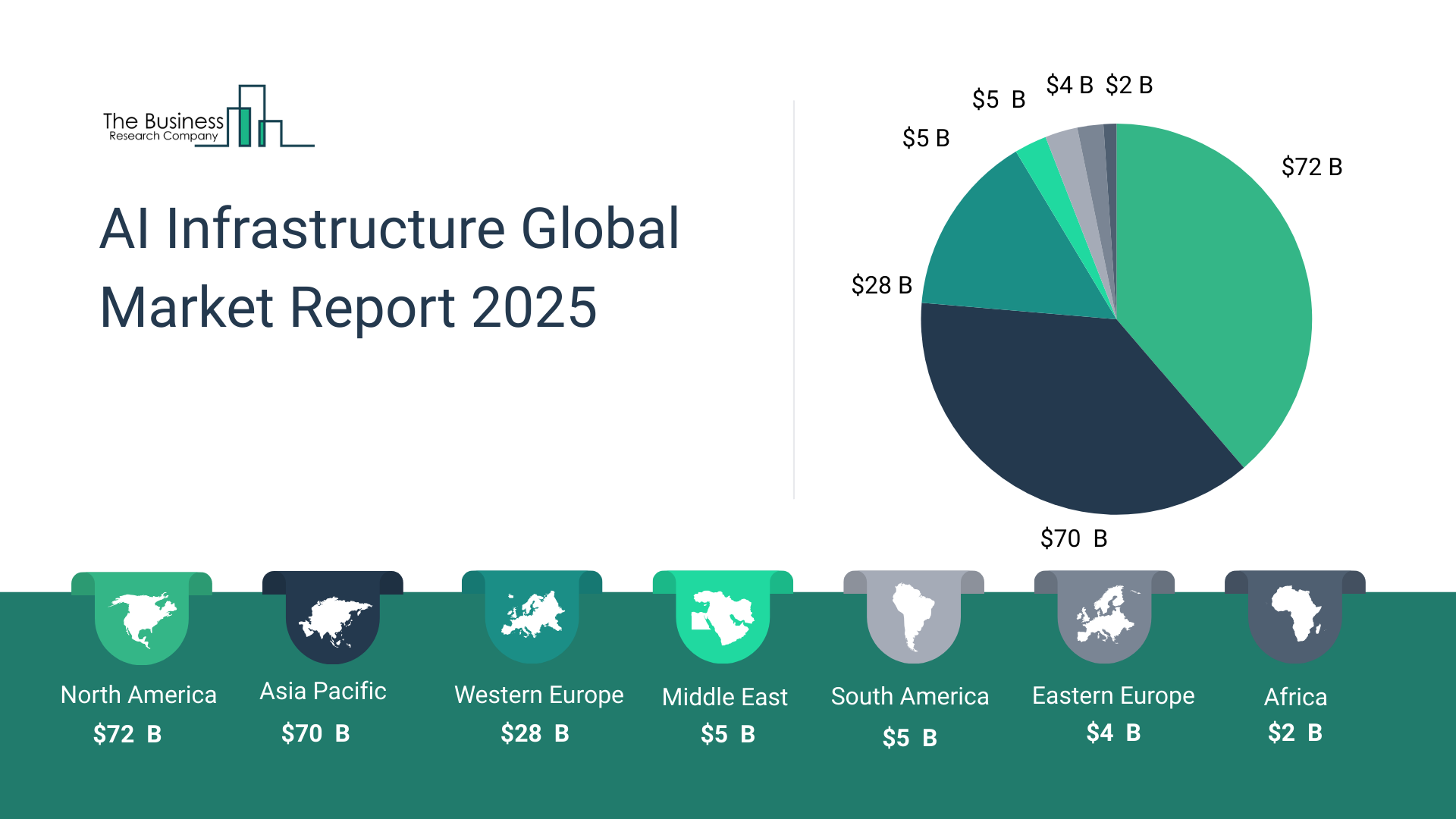

- Charts of capex trends and market concentration

Conclusion

Santoli's insights pose a crucial question for late 2025 and beyond: Can markets endure a rotation out of AI-infrastructure without triggering a broader correction? Investors and policymakers will closely monitor capex signals and hardware orders as this thesis unfolds.

Images should be sourced from official corporate image libraries for accuracy and licensing.