Meta Stock Faces Headwinds as AI Valuation Concerns Sweep Tech Sector

Meta Platforms faces mounting pressure as investor sentiment shifts amid broader concerns about artificial intelligence valuations across the technology industry. The company's share performance reflects growing skepticism about AI spending returns.

Meta Stock Faces Headwinds as AI Valuation Concerns Sweep Tech Sector

Meta Platforms' stock has come under significant pressure as investors reassess the technology sector's artificial intelligence valuations. The shift in market sentiment reflects broader concerns about whether massive AI infrastructure investments will deliver proportionate returns, creating headwinds for even the largest tech companies.

The Valuation Question

The recent decline in Meta's share price underscores a critical inflection point in how the market evaluates AI-related spending. For years, technology companies have justified substantial capital expenditures on artificial intelligence infrastructure with promises of transformative productivity gains and new revenue streams. However, as these investments accumulate without clear monetization pathways, investor confidence has begun to waver.

Meta, like its peers, has committed billions to AI development and infrastructure. The company's aggressive capital allocation strategy—designed to position itself at the forefront of AI innovation—now faces scrutiny from shareholders questioning the timeline and magnitude of expected returns.

Market Context and Broader Implications

The pressure on Meta's valuation is not isolated. The technology sector more broadly has experienced a recalibration as investors demand clearer evidence of AI's commercial viability. This represents a departure from the earlier enthusiasm that characterized much of 2023 and 2024, when AI announcements alone could move markets.

Key factors influencing the current environment include:

- Spending efficiency concerns: Questions about whether current AI capital expenditures will generate adequate returns

- Competitive dynamics: Uncertainty about which companies will ultimately dominate AI applications

- Regulatory headwinds: Ongoing scrutiny of data practices and AI governance

- Macroeconomic sensitivity: Tech valuations' vulnerability to interest rate expectations

Technical Analysis Perspective

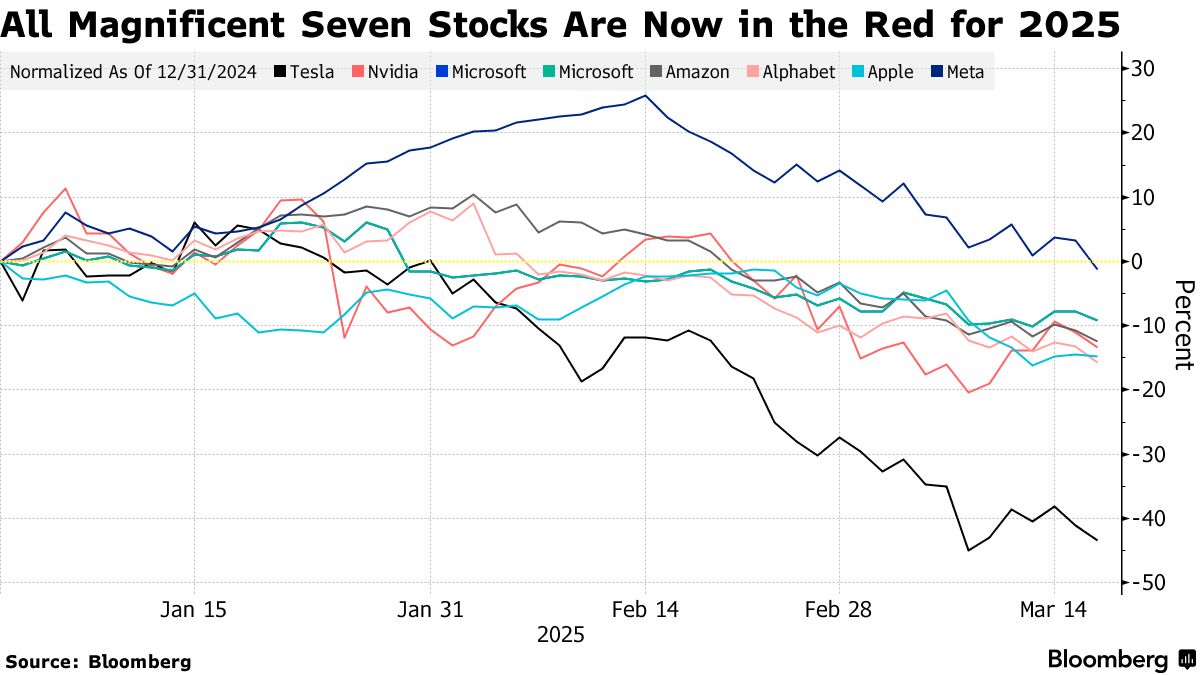

From a technical standpoint, Meta's stock performance reflects the broader rotation away from high-growth, capital-intensive narratives. The company's valuation multiple compression mirrors similar patterns across the Magnificent Seven, as investors reassess risk-reward profiles in the AI era.

The shift suggests that market participants are moving beyond simple "AI exposure" investment theses toward more granular analysis of actual AI monetization. This disciplined approach, while creating near-term headwinds for companies like Meta, may ultimately establish more sustainable valuation foundations.

Forward-Looking Considerations

Meta's path forward depends on demonstrating tangible returns from its AI investments. The company must articulate clear use cases—whether through improved advertising targeting, content recommendations, or entirely new products—that justify its capital allocation decisions.

Investors will likely remain cautious until Meta and similar companies provide concrete evidence of AI-driven revenue acceleration. Quarterly earnings reports will become increasingly important for validating the company's strategic direction.

Key Takeaways

The current pressure on Meta's stock reflects a healthy market correction in how technology companies are valued. Rather than a fundamental indictment of AI's potential, the decline represents a necessary recalibration toward accountability in capital allocation.

For investors, this environment demands careful analysis of which companies can credibly demonstrate AI's commercial impact. Meta's substantial resources and market position provide advantages, but execution on AI monetization will ultimately determine whether current valuations prove justified.

Key Sources: Analysis based on Meta's capital allocation strategy and broader technology sector valuation trends as reflected in 2025 market performance data and technical analysis frameworks.