Micron Raises Q2 Revenue Forecast Amid AI Memory Demand

Micron Technology raises Q2 revenue forecast to $10.7 billion amid surging AI-driven memory demand, boosting shares by 12%.

Micron Raises Q2 Revenue Forecast Amid AI Memory Demand

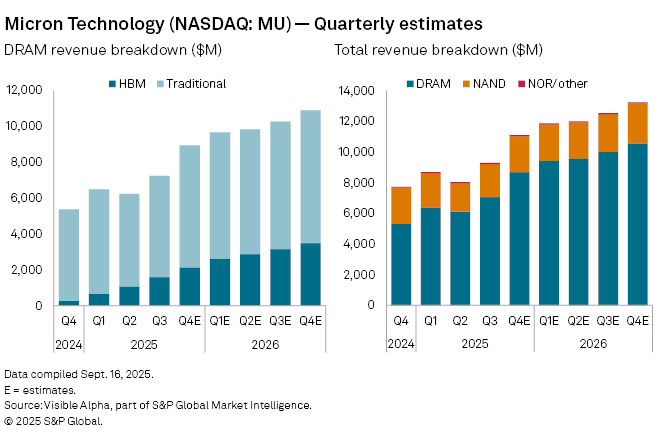

Micron Technology, a leading U.S. manufacturer of computer memory chips, has issued an updated revenue forecast for its fiscal second-quarter 2025, projecting approximately $10.7 billion—a significant increase from its prior estimate of $9.3 billion. This optimistic outlook highlights the growing demand for high-bandwidth memory (HBM) driven by the artificial intelligence boom, resulting in a 12% surge in Micron's shares during after-hours trading.

AI-Driven Market Dynamics

The forecast reflects robust market dynamics where AI applications, especially in data centers and generative AI models, require substantial amounts of advanced memory. Micron's update positions the company as a key player in this trend, surpassing earlier Wall Street expectations and indicating sustained momentum in the semiconductor sector.

Image: Micron's corporate logo overlaid on a stock performance chart highlighting the 12% share jump following the Q2 guidance raise, illustrating investor enthusiasm for AI memory demand.

Background on Micron's AI Pivot

Micron Technology has long been a leader in DRAM (dynamic random-access memory) and NAND flash production. The AI revolution has propelled its high-performance segments into prominence. The company's HBM3E memory chips, essential for accelerating AI training and inference in GPUs from Nvidia and others, have experienced unprecedented demand. This surge aligns with hyperscalers like Microsoft, Google, and Amazon increasing their AI infrastructure investments.

Prior to this update, Micron was navigating a volatile memory market recovering from post-pandemic oversupply. Fiscal first-quarter results already showed strength, with revenue beating estimates, but the Q2 guidance raise amplifies optimism. Analysts note that AI-related sales now constitute a growing portion of Micron's portfolio, with HBM capacity fully sold out through 2025.

Image: Close-up of Micron's HBM3E high-bandwidth memory module, a key product driving the company's AI revenue surge.

Key Financial Highlights and Market Reaction

Micron's revised Q2 forecast anticipates revenue growth of over 15% sequentially, driven by record HBM shipments and improved pricing across DRAM and NAND. Gross margins are expected to expand to the mid-30% range, reflecting operational efficiencies and premium AI product mixes.

| Metric | Prior Guidance | Updated Guidance | Change |

|---|---|---|---|

| Q2 Revenue | $9.3 billion | $10.7 billion | +15% |

| Gross Margin | Low-30s% | Mid-30s% | Expansion |

| Share Price Reaction | N/A | +12% after-hours | N/A |

Traders anticipate continued volatility, with options pricing implying significant post-earnings moves. Micron's stock has already climbed 176% year-to-date in some tracking periods, prompting debates on whether AI hype justifies the valuation—trading at forward multiples above historical averages.

Strategic Initiatives Fueling Growth

Micron is aggressively scaling production to capitalize on AI. Key moves include:

- HBM capacity ramp-up: Sold out through 2025, with HBM4 development underway for next-gen AI systems.

- U.S. manufacturing investments: Over $15 billion committed to Idaho and New York facilities under the CHIPS Act, aiming for 40% domestic advanced packaging by 2030.

- Diversification: Beyond AI, automotive and consumer electronics provide balance, though AI now drives 70%+ of growth forecasts.

CEO Sanjay Mehrotra has repeatedly stressed AI as a "once-in-a-generation" opportunity, with recent calls quoting, "Demand for our leading-edge products remains exceptionally strong."

Image: Micron CEO Sanjay Mehrotra presenting at a recent earnings call, discussing AI memory demand.

Industry Impact and Future Outlook

Micron's forecast reverberates across tech, validating the AI infrastructure buildout. It bolsters Nvidia's ecosystem, where Micron supplies memory for H100 and Blackwell GPUs, and signals pricing power returning to memory makers after years of troughs.

Challenges persist: Potential AI investment slowdowns, U.S.-China trade restrictions limiting exports, and competition from Samsung's HBM dominance. Yet, consensus analyst targets hover around $150/share, implying further upside.

Long-term implications include a reshaped semiconductor landscape favoring AI specialists. Micron's guidance suggests the memory cycle has decisively turned, with AI absorbing supply and pushing utilization rates above 90%. For investors, this cements Micron as a pure-play AI beneficiary, though execution on capacity will be pivotal.

As data center capex hits records—projected at $300 billion globally in 2025—Micron's trajectory mirrors the sector's resilience. Stakeholders watch closely as earnings unfold, with AI's insatiable memory appetite showing no signs of abating.