Nvidia Faces 'No-Win' Situation Amid AI Bubble Concerns

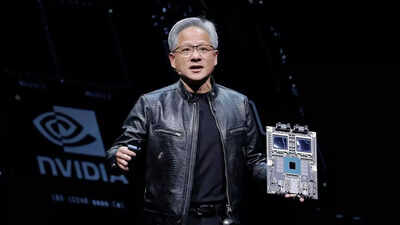

Nvidia CEO Jensen Huang describes the company's position as a 'no-win situation' amid AI bubble concerns, highlighting pressures from market expectations and geopolitical issues.

Nvidia Faces 'No-Win' Situation Amid AI Bubble Concerns

Nvidia, a leader in semiconductor technology and AI innovation, is navigating a challenging landscape as discussions about an AI bubble intensify. In a leaked internal meeting, CEO Jensen Huang described the company's position as a “no-win situation,” highlighting the complex pressures Nvidia faces despite its dominant role in the AI hardware market.

The Context: Nvidia’s Growth and Expectations

Nvidia has been instrumental in advancing the AI revolution, largely due to its powerful GPUs and the new Blackwell architecture chips designed for AI workloads. The company’s shares have surged dramatically in recent years, reflecting investor enthusiasm about AI’s potential. However, with soaring valuations, concerns about an AI “bubble” have grown louder across financial and tech sectors.

In the leaked meeting reported by Fortune and corroborated by Business Insider and Bloomberg, Huang expressed that Nvidia is caught between managing high market expectations and the inherent volatility of cutting-edge tech markets. Huang reportedly stated, “The whole world would've fallen apart” if Nvidia had reported a disappointing quarter, underscoring the immense pressure to continuously outperform.

Why Nvidia Feels It’s in a “No-Win Situation”

Several factors contribute to Nvidia’s challenging position:

-

Skyrocketing Investor Expectations: Nvidia’s stock price demands near-perfect execution every quarter. Any sign of slowing growth or supply constraints risks investor backlash.

-

AI Market Volatility: The AI industry is still emerging, with unpredictable demand cycles and hype-driven investment. The rapid pace of innovation means chips can become obsolete quickly, pressuring Nvidia to constantly innovate.

-

Global Supply Chain and Geopolitical Issues: Ongoing tensions, particularly involving China, pose risks to Nvidia’s supply chain and market access. While demand in China remains strong, regulatory and geopolitical uncertainties loom.

-

Balancing Short-Term Results with Long-Term Innovation: Nvidia must deliver strong quarterly financials while investing heavily in research and development for next-generation AI chips, including its Blackwell series.

Nvidia’s Response: Confidence in Product Pipeline and Market Demand

Despite these challenges, Huang remains optimistic about Nvidia’s future. Bloomberg reports that Huang reiterated the company has “plenty of new chips to sell,” with the Blackwell architecture expected to further cement Nvidia’s leadership in AI processing.

The Blackwell chips, designed specifically for AI training and inference, showcase breakthroughs in energy efficiency and performance. This next-generation architecture is critical for Nvidia to maintain its competitive edge against emerging rivals such as AMD, Intel, and specialized AI chip startups.

Moreover, demand from sectors like telecommunications, cloud providers, and enterprise AI remains robust. Light Reading highlights how Nvidia is expanding its footprint into telecom infrastructure, a sector increasingly reliant on AI-powered hardware.

Industry Impact and Broader Implications

Nvidia’s “no-win” narrative reflects a broader theme in the AI hardware industry: balancing hype with sustainable growth. The company’s situation serves as a cautionary tale for investors and tech firms alike about the risks of overheated markets.

-

Investor Sentiment: Nvidia’s stock price volatility could influence market sentiment toward other AI-related companies, potentially leading to a broader correction if growth expectations are not met.

-

Innovation Pace: The pressure to innovate rapidly may accelerate AI hardware advancements but could also lead to increased R&D costs and operational risks.

-

Geopolitical Sensitivities: Nvidia’s challenges highlight how global supply chains and tech geopolitics intertwine with AI’s future, particularly regarding China and export controls.

Conclusion: Navigating Uncertainty with Strategic Agility

Nvidia remains the undisputed leader in AI hardware, with a strong product pipeline and high demand. Yet, CEO Jensen Huang’s remarks reveal the delicate balancing act required to sustain growth amid market skepticism and geopolitical uncertainty.

The company’s ability to deliver on its technological promises without faltering under market pressures will be closely watched by investors and industry observers. Nvidia’s journey epitomizes the complexities of scaling AI innovation in a world where expectations and realities often diverge.

Relevant Images

- Jensen Huang, Nvidia CEO: Portraits from recent conferences or Nvidia’s official events.

- Nvidia Blackwell GPU Architecture: Official product images or slides showcasing the new chip design.

- Nvidia Logo: For branding context.

- Nvidia GPUs in Data Centers: Visuals illustrating Nvidia hardware deployed for AI workloads.

These images collectively provide visual context to Nvidia’s strategic position and technological leadership.

This coverage integrates the latest information as of November 2025, reflecting the current state of Nvidia’s AI business and market dynamics.