Nvidia Shares Rise on Potential Easing of China Export Restrictions

Nvidia shares rise on hopes of easing U.S. export restrictions to China following Trump's remarks, impacting the semiconductor industry and global tech supply chains.

Nvidia Shares Rise on Potential Easing of China Export Restrictions

Nvidia Corporation’s stock price experienced a significant rally in late October 2025, fueled by renewed optimism tied to potential easing of U.S. export restrictions on its cutting-edge Blackwell GPUs to China. This surge was largely catalyzed by comments made by former President Donald Trump, which investors interpreted as a sign that geopolitical tensions between the U.S. and China might ease, allowing Nvidia to regain access to one of its most important markets. The implications for Nvidia’s business, the semiconductor industry, and global tech supply chains are substantial, highlighting the critical intersection of politics and technology in today’s global economy.

Background: Nvidia’s Blackwell GPUs and U.S.-China Export Restrictions

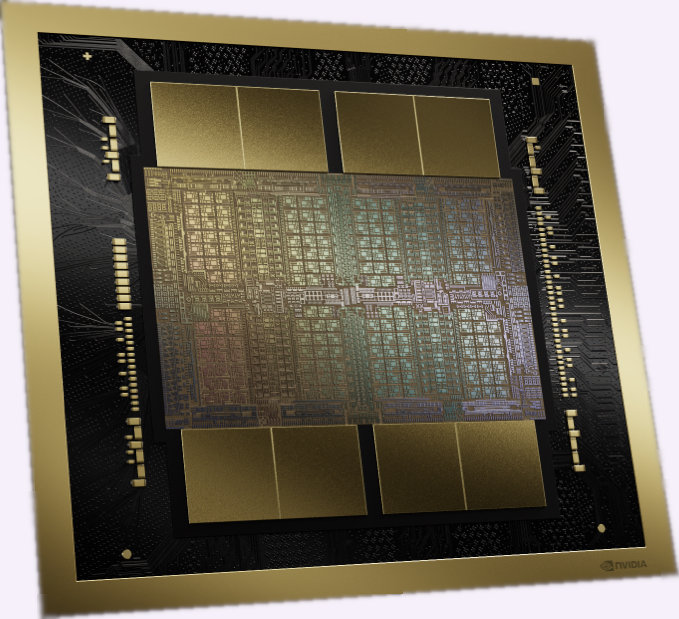

Nvidia, a leading American semiconductor company famed for its graphics processing units (GPUs), launched its latest architecture, Blackwell, earlier this year. The Blackwell GPUs represent a major leap in AI and high-performance computing capabilities, designed for use in data centers, AI training, gaming, and professional visualization.

However, since mid-2024, U.S. government restrictions have barred companies like Nvidia from selling their most advanced chips, including Blackwell, to Chinese firms, citing national security concerns amid intensifying U.S.-China tech rivalry. These export controls have significantly impacted Nvidia’s revenue potential in China, which accounts for a large share of its GPU sales.

Trump’s Remarks: A Catalyst for Market Optimism

On October 28, 2025, Donald Trump made public comments suggesting that negotiations or policy shifts might soon allow more leniency in U.S. tech exports to China. While the statements were not official government policy, they sparked a wave of speculation in financial markets that the Biden administration or a future U.S. government might relax some restrictions, especially concerning Nvidia’s Blackwell GPUs.

Following these remarks, Nvidia’s shares surged by over 7% in a single day on the NASDAQ, marking one of the most significant one-day gains in recent months. Market analysts noted that the rally reflects investor hopes that Nvidia could resume lucrative sales to Chinese data centers and AI developers, potentially unlocking billions in additional revenue.

Industry and Market Impact

Nvidia’s Financial Outlook

- Revenue Growth Potential: China represents roughly 20-25% of Nvidia’s total revenue, primarily from its data center and gaming segments. Resuming Blackwell GPU sales could add an estimated $2-3 billion annually.

- Stock Market Reaction: Nvidia’s market capitalization briefly crossed $1 trillion following the share price jump, reaffirming its position as one of the most valuable semiconductor companies globally.

- Supply Chain Dynamics: Reopening the Chinese market could alleviate some pressure on Nvidia’s inventory and production planning, which has been complicated by the export bans.

Broader Semiconductor Industry Implications

- Geopolitical Sensitivities: The Nvidia case underscores the challenges semiconductor companies face amid geopolitical tensions. U.S. export controls aim to limit China’s access to advanced tech but also risk fragmenting global supply chains.

- Competitor Landscape: Competitors like AMD and Intel are also closely watching U.S.-China relations, as export policies affect their ability to compete in large markets.

- Technological Leadership: Nvidia’s Blackwell architecture symbolizes U.S. technological leadership in AI hardware, which the government is keen to protect. Balancing this leadership with economic interests in China remains complex.

Context and Future Outlook

The Nvidia stock rally sparked by Trump’s remarks is emblematic of the broader uncertainty and hope in the semiconductor sector regarding U.S.-China relations. While no formal policy changes have yet been announced, the market’s reaction indicates that even informal political signals can profoundly impact technology stocks.

Analysts caution that any easing of export restrictions will depend on multiple factors, including ongoing U.S. national security assessments, trade negotiations, and broader geopolitical considerations. The Biden administration has maintained a firm stance on protecting critical technology but has also expressed interest in stabilizing supply chains and economic ties with China.

For Nvidia, securing access to the Chinese market is critical not just for revenue but also for maintaining its global technological dominance. The Blackwell GPUs are integral to AI advancements worldwide, and their restricted distribution hampers both Nvidia’s growth and the global AI ecosystem.

Conclusion

Nvidia’s recent stock surge, driven by Donald Trump’s comments hinting at possible easing of export controls on Blackwell GPUs to China, highlights the intricate interplay between geopolitics and technology markets. While the future of U.S.-China tech trade remains uncertain, Nvidia stands to benefit significantly if restrictions are loosened. The episode underscores the importance of political developments in shaping the semiconductor industry’s trajectory and the global AI hardware landscape.

Investors and industry watchers will be closely monitoring official policy updates in the coming weeks as the situation develops, with Nvidia’s fortunes heavily tied to the evolving geopolitical environment.