Nvidia's AI Market Surge: A 60% Rally on the Horizon

Nvidia is set for a 60% stock rally as AI infrastructure demand surges, driven by its market dominance and strategic partnerships.

Nvidia's AI Market Surge: A 60% Rally on the Horizon

Nvidia is poised for a significant stock rally of nearly 60% amid surging demand for AI infrastructure, according to a recent forecast by Cantor Fitzgerald cited by CNBC. This bullish outlook reflects Nvidia’s dominant position in the AI chip market and the broader growth of the AI ecosystem, which is forecasted to become a multi-trillion-dollar industry over the coming decade.

Nvidia’s Market Leadership in AI Chips

Nvidia currently controls approximately 94% of the AI chip market, a commanding share that underscores its critical role in powering the AI revolution across data centers, cloud platforms, and edge computing environments. The company's GPUs (graphics processing units) are foundational to training and running artificial intelligence models, including large language models and generative AI systems that have reshaped technology landscapes worldwide.

In Q2 2025, Nvidia reported a 56% year-over-year revenue increase, reaching $46.7 billion, driven primarily by explosive demand for its AI chips in data centers and cloud infrastructure. This growth stands out despite a broader slowdown in the cloud sector, highlighting Nvidia’s unique positioning as an indispensable AI infrastructure provider.

Market Growth and Strategic Partnerships

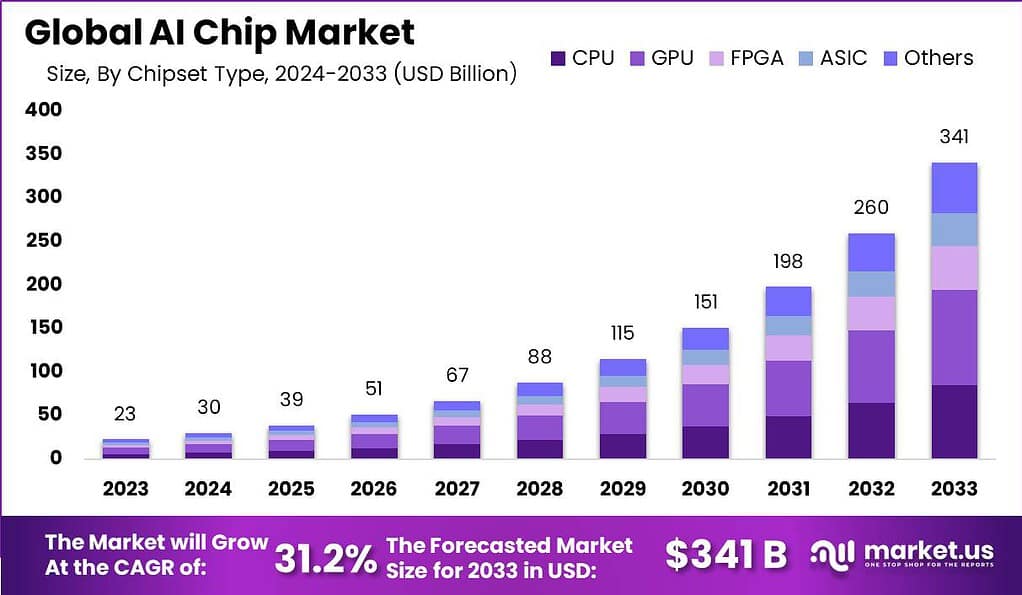

The AI infrastructure market is expected to expand dramatically, with projections estimating a compound annual growth rate of 19.2%, reaching $3.68 trillion by 2034. This growth is fueled by increasing AI adoption across industries, from healthcare and automotive to finance and entertainment.

Nvidia has strategically cemented its leadership through partnerships and investments, including a $5 billion collaboration with Intel and a landmark $100 billion deal with OpenAI to supply hardware for advanced AI model training. These agreements not only secure Nvidia’s role in future AI development but also enable it to influence the architecture and scaling of next-generation AI systems.

Additionally, Nvidia’s investments in 49 AI startups in 2024 showcase its commitment to shaping AI research directions and expanding its ecosystem. The company is also navigating geopolitical challenges by strengthening global supply chains to ensure consistent chip availability.

Hybrid AI Architectures and Ecosystem Expansion

Nvidia is innovating beyond hardware by advancing hybrid AI architectures that span on-premises data centers and cloud environments. This hybrid approach allows enterprises to deploy AI workloads flexibly, supporting both private and public cloud models.

Moreover, Nvidia’s expanding software ecosystem, including its CUDA platform and AI frameworks, enhances developer accessibility and accelerates AI deployment. This integrated approach positions Nvidia to capture growth from both enterprise cloud providers and organizations building private AI infrastructures.

Stock Market Implications and Investor Sentiment

Cantor Fitzgerald’s projection that Nvidia’s stock could rise by nearly 60% reflects widespread confidence in the company’s growth trajectory and AI market dominance. Investors are increasingly viewing Nvidia as a core holding in the AI investment landscape due to its:

- Unrivaled market share in AI chips

- Strong revenue growth amid expanding AI adoption

- Strategic partnerships securing future demand

- Broad ecosystem enabling AI innovation across sectors

This optimism is supported by analyst reports and Morgan Stanley’s forecasts, which place Nvidia at the center of the “AI buy zone” in 2025, highlighting it as a top candidate for capitalizing on the AI-driven industry transformation.

Context and Industry Impact

Nvidia’s rise is emblematic of the wider tech sector’s pivot toward AI and machine learning. As AI models grow in complexity and scale, the demand for specialized, high-performance computing chips has exploded. Nvidia’s GPUs are currently the gold standard for these workloads, ahead of competing architectures.

This dominance has ripple effects, influencing supply chains, software development, and corporate investment strategies. The company’s success also raises competitive stakes, prompting rivals like AMD, Intel, and emerging AI chip startups to accelerate innovation.

Furthermore, Nvidia’s growth supports the broader trend of AI integration into everyday technology and business operations, which is expected to transform productivity, creativity, and decision-making at scale.

Visuals Relevant to This Topic

- Nvidia corporate logo: Symbolizing the company’s brand as a leader in AI technology.

- Nvidia GPUs and AI chips: Images showcasing the latest generation of Nvidia AI processors used in data centers.

- Charts of Nvidia’s stock performance: Visualizing the recent surge and forecasted rally.

- Infographics of AI infrastructure market growth: Illustrating the projected $3.68 trillion market expansion.

- Images of Nvidia’s partnerships: Including logos of OpenAI and Intel to highlight strategic collaborations.

Nvidia’s near-term outlook appears exceptionally bullish as the AI infrastructure market swells and the company consolidates its role as the backbone of global AI advancements. With strong financials, strategic alliances, and a vast ecosystem, Nvidia is uniquely positioned to sustain its growth momentum and deliver substantial returns to investors.