Nvidia's Stock Faces Bubble Concerns Amidst AI Boom

Nvidia's stock faces potential bubble concerns despite AI-driven growth, with investors divided on its valuation sustainability.

Nvidia's Stock Faces Bubble Concerns Amidst AI Boom

Nvidia, a leader in semiconductors and AI chips, has been at the center of market discussions due to its rapid stock price increases and the potential for a speculative bubble. Despite its significant growth, some investors remain cautious, suggesting the stock may be overvalued.

Nvidia’s Meteoric Rise and Current Market Context

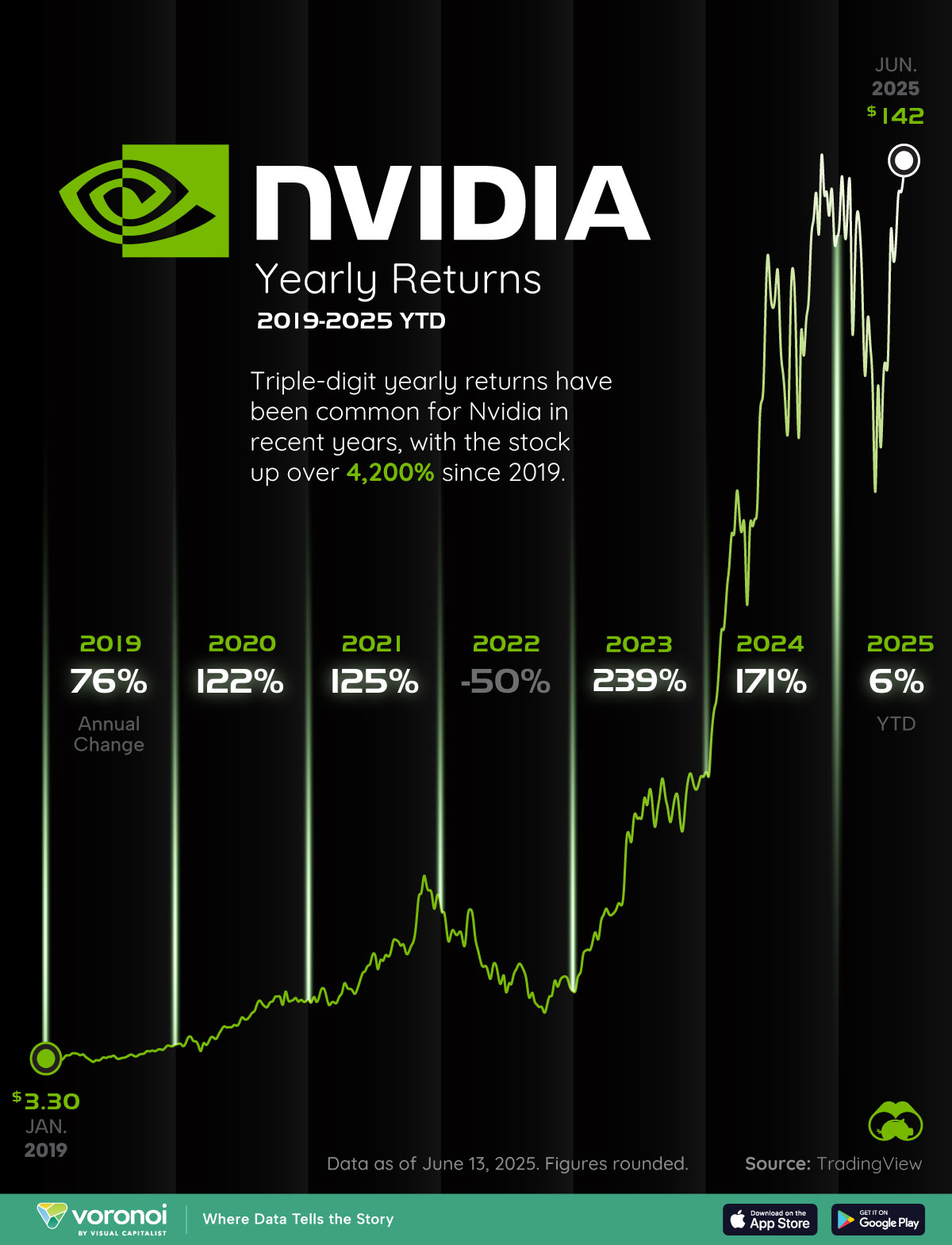

Since 2023, Nvidia's stock has experienced remarkable growth, fueled by demand for AI chips used in generative AI models, gaming, data centers, and autonomous vehicles. The stock surged approximately 239% in 2023 and another 171% in 2024. However, in 2025, the growth rate slowed to 34% year-to-date, suggesting a possible plateau.

As of late October 2025, Nvidia's stock trades between $186 and $190 per share. Analysts predict a potential rise to $220 by year-end, but caution about possible volatility. Technical analysis indicates key support at $172 and resistance at $219, highlighting potential price swings.

The Bear’s Perspective: “This Is Not My First Bubble”

A prominent Nvidia bear, experienced with past tech bubbles, argues that Nvidia's valuation multiples are stretched. He warns that investor enthusiasm around AI could have inflated Nvidia's stock to unsustainable levels.

Key concerns include:

- Competition from AMD, Intel, and new AI hardware players.

- Macroeconomic challenges like interest rate hikes and supply chain issues.

- AI adoption risks that could slow or shift demand.

His views are detailed in a Bloomberg article titled “This Is Not My First Bubble.”

Industry Reaction and Market Sentiment

While some remain bearish, many analysts are bullish on Nvidia, citing:

- Dominant market share in GPUs critical for AI.

- Expanding data center revenues and cloud partnerships.

- Continued innovation in AI architectures.

The market remains polarized, with investors weighing the risk of a correction against Nvidia's technological strengths.

Stock Price Forecasts and Outlook

Near-term forecasts for Nvidia's stock are mixed but optimistic, with targets ranging from $190 to $220 by the end of 2025. Long-term predictions through 2029 suggest potential volatility, with some estimates as high as $1,700 per share.

Visual Context

Relevant visuals include:

- Nvidia logos and AI GPU product photos.

- Stock price performance charts from 2023 to 2025.

- Photos of CEO Jensen Huang.

- Infographics on AI market growth.

Implications for Investors and the Tech Sector

Nvidia's stock debate highlights the balance between innovation-driven growth and valuation discipline. While Nvidia's chips are key to the AI revolution, the bear's warnings remind investors of the cyclical nature of tech markets.

Nvidia's trajectory will be a bellwether for AI-driven demand in the semiconductor industry. A correction could impact related stocks and investment strategies in AI, gaming, and cloud computing.

The discourse around Nvidia reflects the tension between transformative technology and market exuberance. As Nvidia continues to lead in AI hardware, the market will watch closely to see if its valuation can sustain the hype.