Revolutionizing Credit Underwriting with Check AI

NETSOL Technologies launches Check AI, a revolutionary AI-native credit decisioning engine, transforming credit underwriting for financial institutions.

Revolutionizing Credit Underwriting with Check AI

NETSOL Technologies, a leader in AI-powered solutions, has unveiled Check AI, a groundbreaking credit decisioning engine set to transform the credit underwriting landscape for financial institutions, OEMs, and dealerships. Launched on October 8, 2025, this AI-native platform is part of NETSOL’s Transcend Finance suite, designed to automate and enhance credit evaluations through cutting-edge artificial intelligence capabilities.

What is Check AI?

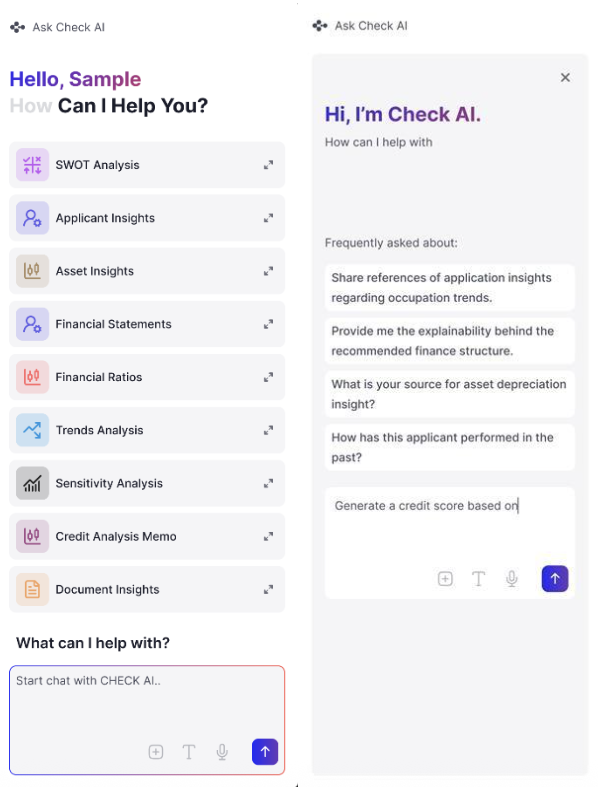

Check AI is a state-of-the-art credit decisioning engine that employs deep reasoning, intelligent automation, and agentic workflows to streamline the traditionally manual and time-consuming credit underwriting process. Unlike conventional credit tools that merely aggregate data, Check AI actively interprets complex financial and market information to formulate actionable credit decisions in real-time. Its core functionalities include:

- Automating data collection from diverse sources such as financial statements, credit histories, and market indicators.

- Processing and analyzing documents with precision to accelerate credit approval timelines.

- Generating comprehensive AI-driven research reports that suggest optimized financing structures, forecast trends, and perform sophisticated risk profiling.

This innovation enables credit analysts and funding professionals to work more efficiently, with improved accuracy and faster decision-making capabilities.

Key Features and Technological Innovations

- AI-Native Architecture: Built from the ground up as an AI-first solution, Check AI integrates seamlessly with NETSOL’s Transcend Finance platform, providing a unified environment for credit evaluation.

- Deep Learning and Reasoning: The system applies advanced machine learning models that go beyond data aggregation to interpret and reason about creditworthiness, market trends, and financial health.

- Agentic Workflows: These workflows allow the engine to autonomously handle multiple underwriting tasks, reducing human intervention while maintaining transparency and control.

- Dynamic Risk Assessment: Check AI synthesizes multi-dimensional data inputs to develop nuanced risk profiles, supporting more informed lending decisions.

- Actionable Insights: The AI-generated reports provide detailed recommendations on finance structures and potential market shifts, empowering lenders to tailor credit offers to specific customer profiles.

Industry Impact and Market Context

The launch of Check AI comes at a pivotal moment in the financial technology space, where speed, accuracy, and automation in credit underwriting are critical to maintaining competitive advantage. Financial institutions and asset financiers face increasing pressure to reduce loan approval times while managing risk effectively in an evolving economic landscape.

By automating manual tasks and delivering in-depth AI-driven insights, Check AI addresses several longstanding challenges in credit decisioning:

- Faster Loan Approvals: Automating data gathering and analysis reduces bottlenecks in the credit evaluation lifecycle.

- Improved Accuracy: AI’s ability to process and interpret large datasets minimizes human error and bias.

- Enhanced Customer Experience: Faster, more accurate decisions translate to better service and tailored financing solutions for borrowers.

- Scalability: The platform’s architecture supports expansion to multiple asset classes and market regions, positioning NETSOL as a key player in global finance technology.

NETSOL Technologies and the Future of AI in Finance

NETSOL Technologies (Nasdaq: NTWK) has established itself as an innovator in AI-powered financial services, particularly in enabling OEMs, dealerships, and financial institutions in asset sales, financing, and leasing. Check AI reflects the company’s commitment to leveraging artificial intelligence to modernize traditional finance processes.

The company plans to showcase Check AI at the upcoming Auto Finance Summit in Las Vegas from October 15–17, 2025, where industry leaders will witness firsthand how AI is reshaping credit decisioning.

Conclusion

NETSOL Technologies’ launch of Check AI marks a significant advancement in AI applications for credit underwriting. By combining intelligent automation with deep data interpretation, Check AI offers financial institutions a powerful tool to accelerate credit decisions, enhance underwriting precision, and better manage risk in an increasingly complex market environment. As AI continues to evolve, Check AI positions NETSOL at the forefront of fintech innovation, driving efficiency and intelligence in lending practices worldwide.

Key Takeaways:

- Check AI is an AI-native credit decisioning engine launched by NETSOL Technologies in October 2025.

- The platform automates credit underwriting tasks, accelerates decision times, and improves accuracy using deep reasoning and intelligent workflows.

- It generates comprehensive AI-driven reports including risk profiles, trend forecasts, and optimized financing strategies.

- Check AI aims to improve efficiency and risk management for OEMs, dealerships, and financial institutions globally.

- NETSOL will demonstrate Check AI at the Auto Finance Summit in Las Vegas, October 15–17, 2025.

This launch underscores the growing integration of AI in financial services, heralding a new era of intelligent automation in credit evaluation.