VRT vs. AMD: 3 Reasons These AI Stocks Could Soar by 2025

Explore why Vertiv and AMD are top AI stock picks for 2025, comparing their growth potential and market strategies.

VRT vs. AMD: 3 Reasons These AI Stocks Could Soar by 2025

The artificial intelligence (AI) boom is reshaping the investment landscape, with Vertiv Holdings Co. (VRT) and Advanced Micro Devices (AMD) standing out as top contenders. Both have earned “Strong Buy” ratings, but which offers the greater upside? This article delves into their financial performance, strategic moves, and analyst outlooks, providing a clear comparison for investors.

Company Overviews

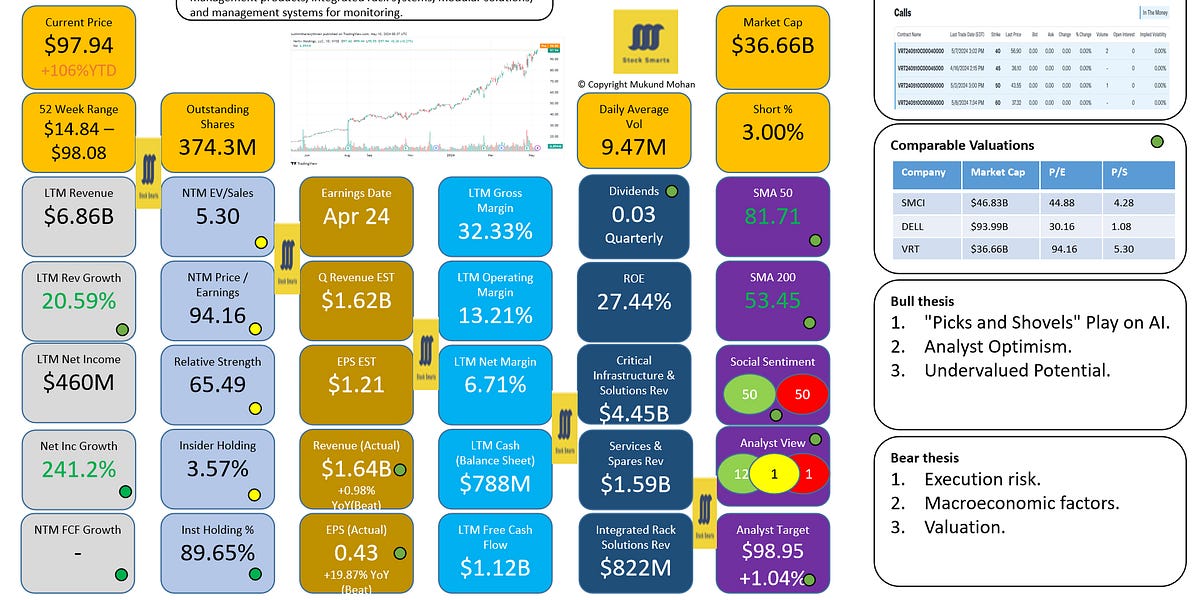

Vertiv Holdings Co. (VRT)

Vertiv specializes in critical digital infrastructure, essential for data centers experiencing growth due to AI demand.

- Stock Performance: VRT surged 53% year-to-date, driven by AI infrastructure demand.

- Financials: Recent EPS of $0.95 beat estimates, with revenue up 35.1% to $2.64 billion.

- Valuation: Trades at a P/E ratio of 83.31 and a PEG ratio of 1.50.

- Institutional Interest: Nearly 90% owned by major funds like Vanguard.

Advanced Micro Devices (AMD)

AMD is a semiconductor leader, expanding into AI chips with its MI300 series.

- Stock Performance: AMD shares rose 93% year-to-date, fueled by AI optimism.

- Strategic Moves: Growth driven by AI chip innovation and partnerships, including OpenAI.

- Market Position: Positioned as a strong second player in AI chips.

Analyst Ratings and Market Sentiment

Both VRT and AMD are rated “Strong Buy,” but with different outlooks:

- Vertiv: Analysts praise strong execution and AI data center growth but caution on valuation risks.

- AMD: Analysts are bullish on AI chip potential, noting competition risks but highlighting strategic partnerships.

Financial and Technical Comparison

| Metric | Vertiv (VRT) | AMD |

|---|---|---|

| YTD Stock Performance | +53% | +93% |

| P/E Ratio | 83.31 | Not specified |

| PEG Ratio | 1.50 | Not specified |

| Revenue Growth (YoY) | +35.1% | Not specified |

| Institutional Ownership | ~90% | Not specified |

| Beta (Volatility) | 1.84 | Not specified |

Industry Context and Implications

The AI investment thesis remains robust, with significant capital flowing into AI infrastructure. For Vertiv, demand for power and cooling solutions is key, while AMD aims to capture AI chip market share.

- Vertiv’s Edge: Benefits from essential infrastructure with recurring revenue.

- AMD’s Opportunity: Success depends on AI chip market execution.

Risks and Considerations

- Vertiv: High valuation and dependency on data center expansion pose risks.

- AMD: Faces semiconductor cycle risks and competitive pressures.

Conclusion

Both Vertiv and AMD are compelling “Strong Buy” candidates, offering different risk/reward profiles. Vertiv provides stable growth, while AMD offers higher potential through innovation. Analysts see slightly greater upside in AMD, but Vertiv remains a strong pick for infrastructure exposure.

For investors, the choice hinges on risk tolerance: Vertiv for steady growth or AMD for high-octane returns in AI chips.

Visuals to Accompany This Story

- Vertiv: Data center infrastructure images, earnings presentation screenshots.

- AMD: MI300 AI accelerators, CEO presentations.

- Comparative Infographics: Charts of stock performance and revenue growth.

- Industry Context: Data center construction and AI demand visuals.