Wall Street Backs Nvidia and Broadcom as AI Chip Leaders for 2026

Wall Street analysts favor Nvidia and Broadcom as top AI chip investments for 2026, citing their dominance in market share and innovation.

Wall Street Backs Nvidia and Broadcom as AI Chip Leaders for 2026

New York, December 2025 – Wall Street analysts overwhelmingly favor Nvidia (NVDA) and Broadcom (AVGO) as premier AI chip investments heading into 2026, citing their dominant positions in the explosive artificial intelligence sector. Amid fierce competition from players like AMD, these two giants lead in market share, innovation, and revenue growth, with consensus price targets signaling double-digit upside. This bullish outlook stems from surging demand for AI infrastructure, data center expansions, and custom silicon solutions, as hyperscalers like Microsoft, Google, and Amazon ramp up investments.

Background on AI Chip Dominance

The AI chip market has skyrocketed, projected to exceed $200 billion by 2028 according to recent industry forecasts from McKinsey and Gartner. Nvidia commands over 80% of the AI accelerator market, powered by its Hopper and Blackwell GPU architectures, which excel in training and inference for large language models. Broadcom, meanwhile, thrives in custom ASICs (application-specific integrated circuits) and networking chips, securing major deals with cloud giants for AI-optimized data centers.

Analysts from TipRanks and Investing.com highlight these firms' resilience amid U.S.-China trade tensions and supply chain shifts. Nvidia's fiscal Q3 2026 earnings, reported last month, smashed expectations with $35 billion in revenue, up 94% year-over-year, largely from data center sales. Broadcom followed suit, posting $14.8 billion in Q4 revenue, a 55% jump, fueled by AI semiconductor demand representing 55% of its total sales.

- Key Statistic: Nvidia's forward P/E ratio stands at 45x, while Broadcom's is 35x – premiums justified by 25-30% projected EPS growth through 2027 (Bloomberg data).

- Wall Street Consensus: 42 of 45 analysts rate Nvidia "Buy" with a $175 median target (25% upside from current $140 levels). Broadcom earns "Strong Buy" from 28 of 30, targeting $280 (20% upside).

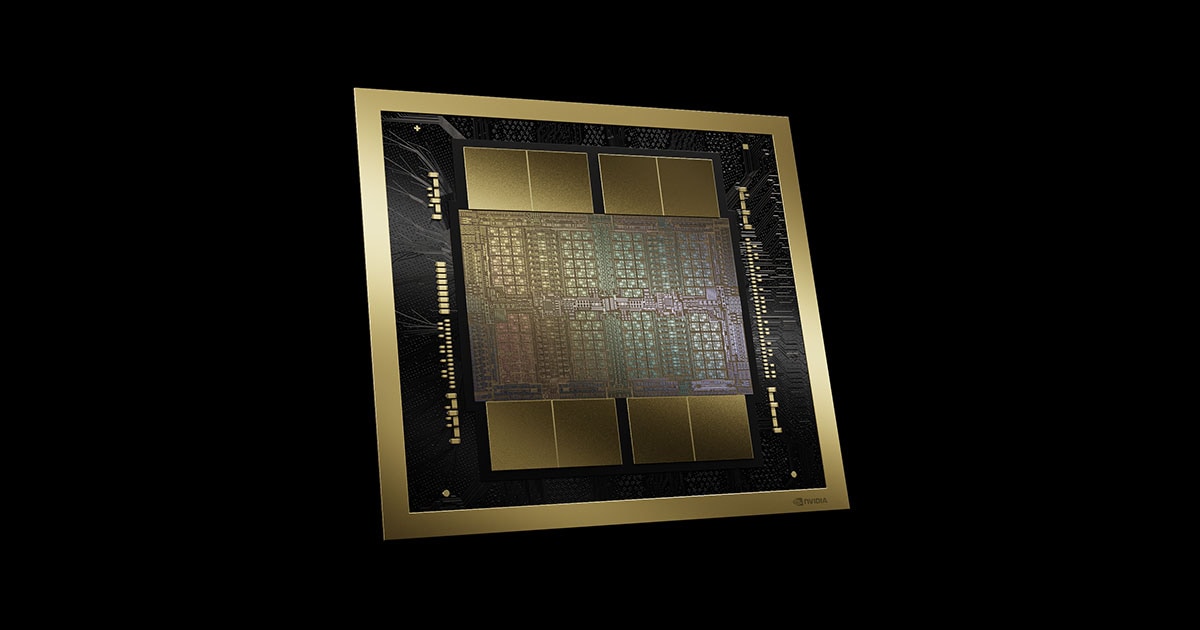

Nvidia's Blackwell platform, a cornerstone of its 2026 AI growth strategy, featuring advanced GPU clusters for trillion-parameter models.

Comparing Nvidia, Broadcom, and Rivals like AMD

Nvidia and Broadcom offer distinct AI plays, differentiating them from AMD's more generalized approach. Nvidia dominates high-performance computing (HPC) with CUDA software ecosystem lock-in, enabling seamless scaling for AI workloads. Broadcom excels in end-to-end AI infrastructure, supplying Ethernet switches, optical components, and bespoke chips – think Google's TPUs or Meta's MTIA.

A Benzinga analysis pits them head-to-head: Nvidia leads in raw compute power, but Broadcom's VMware acquisition bolsters software margins, projecting $15 billion in AI revenue for FY2026. AMD, with its MI300X Instinct accelerators, trails at under 10% market share, hampered by software ecosystem gaps despite competitive pricing.

| Company | AI Market Share | Q3 2026 AI Revenue | 2026 Price Target Upside |

|---|---|---|---|

| Nvidia | 80-85% | $28B | +25% |

| Broadcom | 15-20% (custom AI) | $8B | +20% |

| AMD | 5-10% | $3B | +15% |

Insider Monkey questions if Broadcom could challenge Nvidia directly, noting its $10 billion+ annual AI chip bookings versus Nvidia's $100 billion run rate. Yet, Wall Street sees complementarity: "Nvidia for brains, Broadcom for plumbing," as one Goldman Sachs note puts it.

Broadcom's Jericho3-AI networking silicon, critical for hyperscale AI data centers supporting Nvidia GPUs.

Analyst Projections and Market Drivers

TipRanks data shows 95% buy ratings for both stocks, with JPMorgan raising Nvidia's target to $200 on Blackwell ramp-up. Broadcom benefits from AI serviceable addressable market (SAM) expanding to $60-90 billion by 2027, per CEO Hock Tan. Drivers include:

- Hyperscaler Capex Boom: $320 billion collective spend in 2026 (Dell'Oro Group).

- Edge AI Growth: Broadcom's Trident 5-X12 chips target inference at the edge.

- Regulatory Tailwinds: U.S. CHIPS Act subsidies favor domestic leaders.

Risks persist – Nvidia faces China export curbs, shaving 5% off FY2026 guidance, while Broadcom navigates VMware integration costs. Still, beta to AI index remains high at 1.8 for both.

Industry Impact and Future Outlook

These endorsements signal AI's maturation beyond hype, reshaping semiconductors into a $1 trillion industry by 2030. Nvidia and Broadcom's duopoly pressures AMD to innovate, potentially sparking price wars or partnerships. Investors eye 2026 catalysts: Nvidia's Rubin architecture reveal at GTC and Broadcom's next-gen 2nm AI chips.

For portfolios, diversification across these plays hedges volatility. As 24/7 Wall St. notes, "In AI, it's not just about chips – it's about the stack." With global AI compute demand doubling annually, Wall Street's backing underscores enduring leadership.