Wall Street's AI Investments: Speculation vs. Infrastructure

Wall Street invests billions in AI stocks, but analysts warn of speculative bubbles overshadowing foundational companies driving AI infrastructure.

Wall Street's AI Investments: Speculation vs. Infrastructure

As artificial intelligence (AI) continues to transform industries, Wall Street is investing billions in AI stocks. However, analysts caution that much of this capital is directed towards speculative bubbles rather than the foundational companies driving the AI revolution. While high-profile names dominate the market conversation, a closer examination reveals lesser-known stocks that are crucial to AI infrastructure, software, and services. These "hidden champions" are propelling the next phase of AI adoption, even as investors focus on more volatile, high-profile plays.

The AI Stock Market: A Tale of Two Tiers

High-Flying Performers and Speculative Mania

The past year has witnessed significant gains for some AI-related stocks. Quantum Computing Inc. (QUBT) leads with a 1,739% one-year return, followed by Palantir Technologies (PLTR, +332%), AppLovin Corp. (APP, +286%), Cerence Inc. (CRNC, +280%), Hut 8 Corp. (HUT, +270%), and SoundHound AI (SOUN, +248%). These returns reflect both genuine technological advancements and speculative fervor reminiscent of the dot-com boom.

Investors are often drawn to the allure of "the next big thing," sometimes overlooking fundamentals in favor of momentum. This behavior has led to inflated valuations for companies with unproven business models, while more established firms building the AI backbone receive less attention.

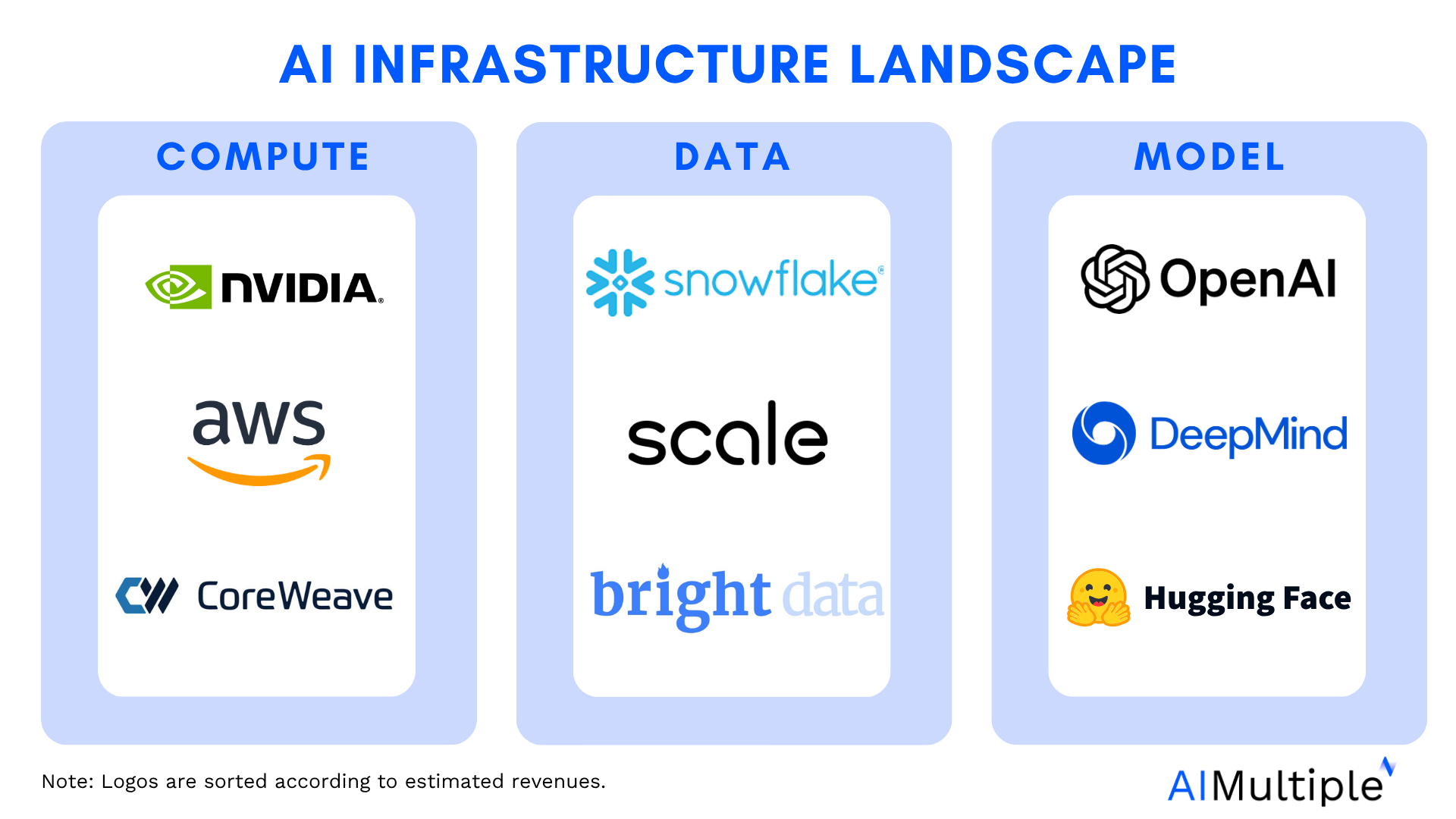

The Real Power Behind AI: Infrastructure and Enablers

Beneath the surface, a different set of companies is enabling the AI ecosystem. These firms provide essential hardware, software, and services that allow generative AI, machine learning, and automation to function at scale. While hyper-scalers like Amazon, Microsoft, and Google capture headlines, the real workhorses include semiconductor manufacturers, data center operators, specialized software providers, and firms offering AI-as-a-service.

MarketWatch highlights ten such stocks critical to AI’s infrastructure but often overlooked by the broader market. These companies may not be household names, but they are indispensable to the deployment and scaling of AI technologies.

Key Companies and Technologies Powering the AI Boom

Semiconductor and Hardware Leaders

- NVIDIA (NVDA): The leader in AI chips, powering data centers and edge devices worldwide.

- Advanced Micro Devices (AMD): A strong competitor in high-performance computing and AI accelerators.

- Taiwan Semiconductor Manufacturing Company (TSMC): The largest contract chipmaker, producing advanced silicon for AI hardware.

Software and Services Enablers

- Palantir Technologies (PLTR): Specializes in big data analytics and AI-driven decision-making platforms.

- AppLovin Corp. (APP): Uses AI for mobile app marketing and monetization.

- Cerence Inc. (CRNC): Focuses on AI-powered voice recognition and natural language processing.

Infrastructure and Support

- Hut 8 Corp. (HUT): A major player in cryptocurrency mining, now pivoting to AI data center operations.

- SoundHound AI (SOUN): Provides conversational AI and voice recognition solutions.

Industry Impact and Market Dynamics

The $7 Trillion Opportunity

Analysts project that AI could drive over $7 trillion in global economic impact in the coming decade. This massive opportunity is attracting unprecedented capital, but its distribution is uneven. While some funds chase the latest AI startup, the real value is created by companies that build and optimize the underlying infrastructure.

Risks of Bubble Behavior

The current market environment recalls previous tech booms, where hype outpaced reality. The danger is that investors may overpay for speculative growth stories while ignoring firms with sustainable competitive advantages. History suggests that when the bubble bursts, infrastructure providers and enablers tend to weather the storm, while flashy ventures collapse.

Context and Implications

Why the Hidden Champions Matter

The companies building AI’s infrastructure—semiconductors, cloud infrastructure, specialized software—are the unsung heroes of this revolution. Their products and services are essential for every layer of the AI stack, from training models to deploying them at scale.

What Investors Should Watch

- Valuation Discipline: Focus on companies with strong fundamentals and recurring revenue streams.

- Diversification: Balance exposure between high-growth AI plays and steady, foundational firms.

- Long-Term Trends: AI adoption is still in its early stages. The biggest winners may not be the most talked-about names today.

The Road Ahead

As AI becomes ubiquitous, the market will likely differentiate between hype and substance. Companies providing the tools, platforms, and infrastructure for AI will continue to see robust demand. For investors, the key is to look beyond the noise and identify the true architects of the AI future.