Amazon's Rufus Hits $10 Billion in Sales: The AI Shopping War Intensifies

Amazon claims its Rufus AI assistant has generated $10 billion in sales from 250 million users, signaling a major shift in how retailers deploy AI to capture customer intent. But can Amazon maintain its edge as competitors rush to build their own shopping assistants?

The AI Shopping War Just Got Real

Amazon's claim that Rufus has driven $10 billion in sales from a 250-million-user base marks a watershed moment in retail AI—and it's forcing the entire industry to reckon with a fundamental shift in how customers discover and buy products. According to Evercore ISI analysts, the AI assistant is becoming a material driver of Amazon's commerce engine, not just a novelty feature. The numbers suggest Rufus isn't merely a chatbot; it's a revenue-generating machine that's reshaping customer behavior at scale.

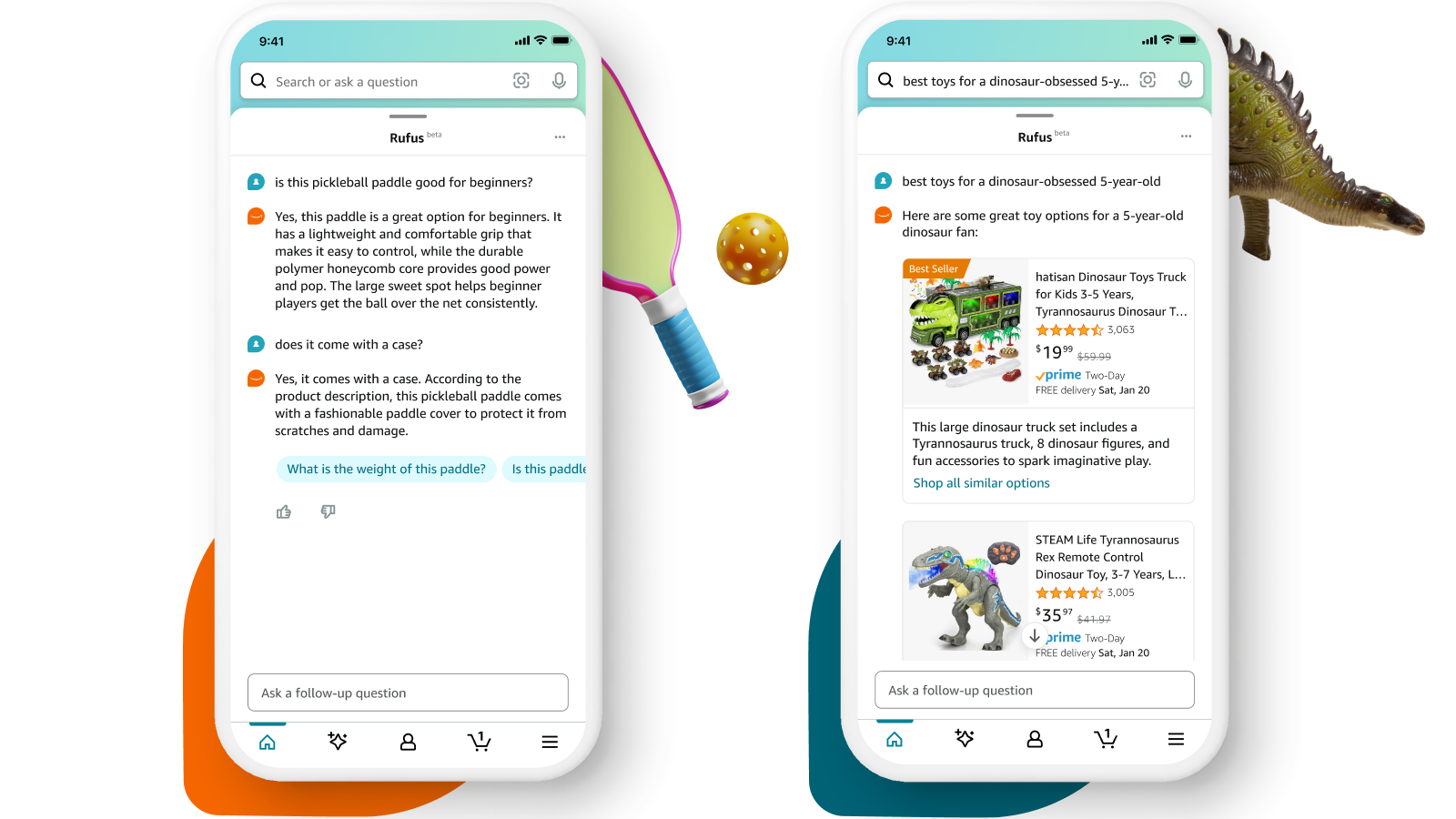

This isn't just about Amazon winning—it's about the battle for customer intent itself. As retail innovation experts note, Rufus represents a critical inflection point where AI moves from search enhancement to active commerce participation. When a customer asks Rufus for product recommendations, Amazon controls the conversation, the comparison, and ultimately, the transaction.

What the Numbers Actually Tell Us

The $10 billion figure—according to Amazon's claims—translates to roughly $40 per user across the 250-million-user base. That's not trivial, but context matters. According to Evercore ISI, this performance has been sufficient to warrant a reaffirmation of Amazon's stock rating, suggesting institutional investors view Rufus as a meaningful contributor to long-term growth.

Key metrics to consider:

- User penetration: 250 million users represents substantial reach, though Amazon's total customer base is larger

- Revenue per user: $40 average suggests strong engagement among active Rufus users

- Adoption velocity: The speed at which Rufus scaled to this level indicates genuine product-market fit, not forced adoption

The Competitive Pressure Mounting

Amazon's success with Rufus has triggered a broader industry reckoning. Retailers and commerce platforms are now racing to deploy their own AI shopping agents, recognizing that the next decade of e-commerce will be defined by conversational commerce and AI-driven discovery. The question isn't whether AI will reshape shopping—it's whether competitors can catch up before Amazon's first-mover advantage becomes insurmountable.

The emerging "agentic commerce" landscape reveals that Rufus is part of a larger transformation where AI agents don't just answer questions—they actively guide purchasing decisions, manage comparisons, and handle post-purchase support. This shifts power dynamics in retail, favoring platforms with the largest datasets and most sophisticated recommendation engines.

The Skepticism Worth Noting

While Rufus's reported performance is impressive, it's important to note that these figures come directly from Amazon's claims. Independent verification of the $10 billion figure remains limited, and the company hasn't disclosed Rufus's profit margin or customer acquisition cost relative to these sales. Some analysts have raised questions about whether AI shopping assistants can maintain user engagement long-term, particularly as novelty wears off and competitors launch their own versions.

What Comes Next

The real story isn't whether Rufus hit $10 billion—it's what happens when every major retailer has an equivalent AI shopping assistant. At that point, differentiation shifts from "do you have AI?" to "whose AI actually understands what I want?" That's where Amazon's data advantage becomes decisive, and where the next phase of retail competition will be won or lost.

The battle for customer intent has begun, and Rufus just proved it's worth fighting for.