Navigating the AI Investment Boom: Strategies for 2025

Explore how investors are navigating the AI boom in 2025, employing diverse strategies to identify market leaders amid rapid technological advancements.

Navigating the AI Investment Boom: Strategies for 2025

The surge in artificial intelligence (AI) innovation has transformed investing landscapes, drawing both retail investors and large institutional players into a competitive race to identify the next AI market leaders. As of late 2025, AI’s integration across industries—from healthcare and finance to autonomous vehicles and creative technologies—has created vast opportunities but also challenges in discerning genuine winners from hype. This article examines how investors of all sizes are navigating the AI boom, the strategies they employ, and the implications for the market.

The AI Investment Boom: Who’s Investing and Why?

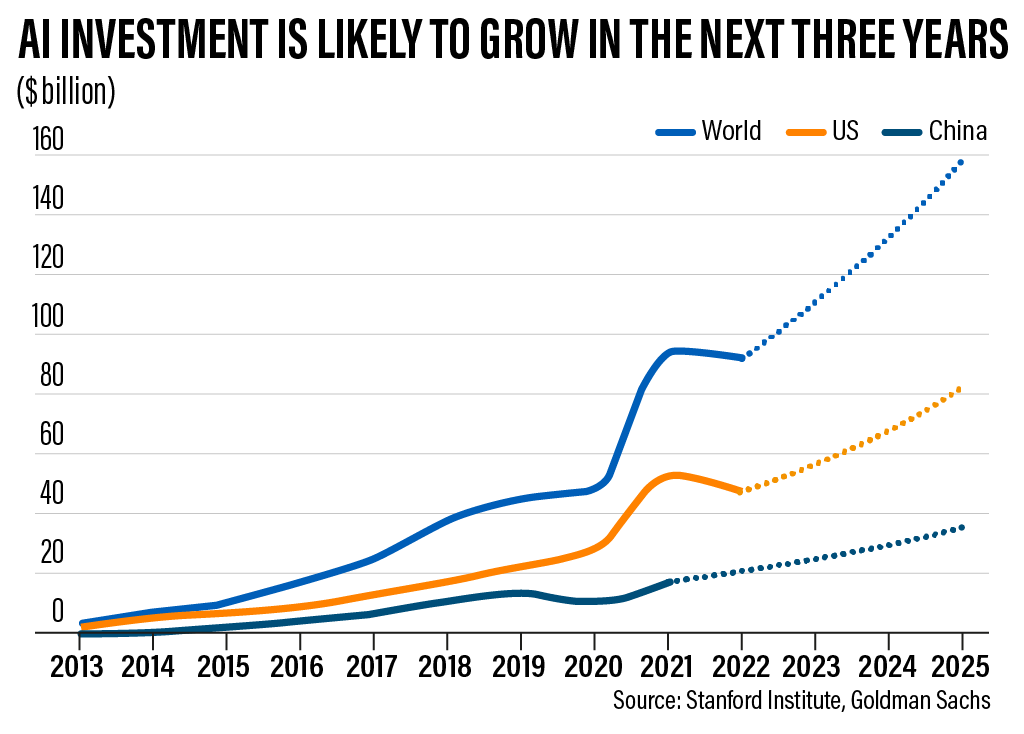

Artificial intelligence has become a dominant force in global markets, driving record investment flows. According to PwC, AI-related investments worldwide reached over $200 billion in 2024, a figure projected to climb steadily. Both small retail investors and large institutional funds are pouring capital into AI-focused stocks, ETFs, startups, and venture capital.

Small Investors: Democratizing AI Investment

Retail investors, empowered by commission-free trading platforms and social media-driven investment communities, are increasingly active in the AI space. Many small investors focus on:

- Publicly traded tech giants like Nvidia, Alphabet (Google), Microsoft, and Meta, which lead AI infrastructure and application development.

- AI-focused ETFs such as the Global X Robotics & Artificial Intelligence ETF (BOTZ) or ARK Autonomous Technology & Robotics ETF (ARKQ), which provide diversified exposure without picking individual stocks.

- Emerging AI startups listed on secondary markets or early-stage companies via crowdfunding or SPACs.

Retail investors often rely on news, earnings reports, and AI product releases to make decisions, sometimes driven by hype cycles but increasingly seeking companies with sustainable AI moats.

Big Investors: Strategic and Data-Driven Approaches

Large institutional investors—including hedge funds, pension funds, and mutual funds—take a more analytical and long-term approach:

- Deep fundamental analysis of AI companies’ R&D pipelines, patent portfolios, and partnerships.

- Quantitative models leveraging alternative data to predict AI adoption trends across sectors.

- Early-stage venture capital investments in promising AI startups, often in collaboration with tech accelerators.

- Active engagement with portfolio companies to influence AI strategy and governance.

Notably, firms like BlackRock and Fidelity have launched dedicated AI funds focusing on companies with robust AI capabilities and ethical standards.

Key Factors Influencing AI Investment Choices

Investors weigh several critical factors when selecting AI winners:

1. Technology Leadership and IP Strength

Companies with proprietary AI models, extensive datasets, and hardware capabilities (e.g., chipmakers like Nvidia and AMD) are favored. Ownership of unique AI algorithms or platforms provides defensibility against competitors.

2. Revenue Models and Profitability

Sustainable monetization of AI, whether through cloud AI services, subscription software, or AI-powered solutions, signals long-term viability. Investors scrutinize recurring revenue and gross margins.

3. Industry Integration and Partnerships

AI firms embedded in high-growth sectors like autonomous driving (Waymo, Tesla), biotech (Illumina, Moderna), or finance (Bloomberg, Palantir) present diversified growth potential.

4. Regulatory and Ethical Considerations

With increasing AI regulation worldwide, companies with transparent AI governance and compliance frameworks are viewed as lower risk.

Market Trends and Notable Winners in 2025

Several companies have emerged as clear AI leaders, attracting investor attention:

- Nvidia remains the dominant supplier of AI chips powering machine learning models.

- OpenAI (backed by Microsoft) leads in generative AI with products like GPT-5 and DALL·E 3, driving cloud AI revenue.

- Alphabet’s DeepMind continues breakthroughs in AI research applied to healthcare and energy.

- UiPath and Automation Anywhere are pioneers in robotic process automation (RPA), benefiting from enterprise AI adoption.

Meanwhile, smaller startups specializing in niche AI applications, such as natural language processing for legal tech or AI-driven drug discovery, have seen significant venture capital inflows.

Implications for Investors and Markets

The AI investment landscape illustrates both opportunity and risk:

- Volatility remains high, as AI hype can lead to rapid price swings.

- Diversification through ETFs or funds helps mitigate single-stock risk.

- Due diligence on company fundamentals and AI capabilities is essential.

- Long-term horizon investing is favored to capture the AI growth trajectory beyond initial excitement.

The democratization of AI investment means more participants are shaping market dynamics, but it also requires better investor education to avoid speculative bubbles.

Conclusion

In 2025, AI continues to reshape investment strategies across the spectrum, from small retail traders to sophisticated institutional investors. Each group leverages distinct approaches to identify AI winners amid rapid technological innovation and evolving market conditions. As AI technologies mature and regulatory frameworks tighten, investors who combine rigorous analysis with strategic vision are best positioned to capitalize on AI’s transformative potential.