Wayfair Stock Surges on Google AI Shopping Protocol Partnership

Wayfair's shares climb following a strategic collaboration with Google to develop an AI-powered shopping protocol, positioning the home goods retailer at the forefront of agentic commerce innovation.

The AI Commerce Battleground Heats Up

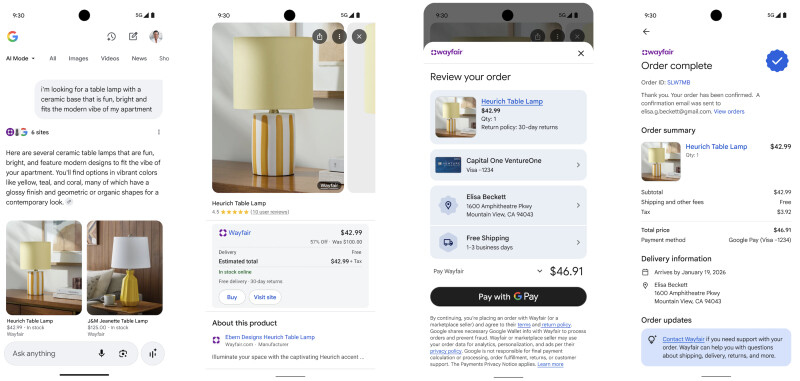

The race to dominate AI-powered shopping just shifted into high gear. Wayfair has partnered with Google to advance AI-powered shopping for the home, marking a significant move in the broader push toward agentic commerce—where autonomous AI agents handle transactions on behalf of consumers. The market has taken notice, with Wayfair's stock experiencing a notable uptick as investors recognize the strategic positioning this partnership provides.

This collaboration arrives at a critical inflection point. Google has announced a new protocol to facilitate commerce using AI agents, fundamentally reshaping how consumers discover and purchase products online. Rather than passive browsing, AI agents will actively negotiate, compare, and complete transactions based on user preferences—a paradigm shift that threatens traditional e-commerce models while creating opportunities for early adopters.

Understanding the Protocol

The Universal Commerce Protocol (UCP) represents Google's infrastructure play in agentic commerce, establishing standardized communication between AI agents and retail platforms. Wayfair's involvement signals that the home goods sector—historically fragmented across thousands of SKUs and suppliers—is ripe for AI-driven optimization.

Key technical elements include:

- Agent-to-Retailer Communication: Standardized APIs enabling AI agents to query inventory, pricing, and availability in real-time

- Transaction Integrity: Built-in verification mechanisms ensuring secure, compliant commerce flows

- Cross-Platform Compatibility: Retailers adopting the protocol gain access to multiple AI agent ecosystems simultaneously

According to Google's broader commerce announcements, this approach democratizes access to AI-driven shopping experiences, leveling the playing field between large retailers and smaller platforms.

Market Implications and Stock Performance

Wayfair's stock surge reflects investor confidence in several factors:

- First-Mover Advantage: Early adoption of the protocol positions Wayfair ahead of competitors like Amazon and Overstock in the agentic commerce space

- Operational Efficiency: AI agents handling routine transactions could reduce customer acquisition costs and improve conversion rates

- Data Advantage: Direct integration with Google's AI infrastructure provides valuable insights into consumer preferences and purchasing patterns

Nasdaq coverage highlights how the partnership strengthens Wayfair's competitive positioning, particularly in a sector where margins are notoriously thin and customer retention is challenging.

The Broader Context

Google CEO Sundar Pichai framed agentic commerce as a cornerstone of the company's 2026 strategy, signaling sustained investment in the infrastructure. Industry analysts have begun dissecting what these announcements mean for retailers and platforms, with consensus emerging that protocol adoption will become table stakes for major e-commerce players within 18 months.

For Wayfair specifically, the partnership addresses a critical vulnerability: the company's reliance on paid search and traditional marketing channels. By embedding itself into Google's agentic commerce ecosystem, Wayfair gains organic discovery mechanisms that bypass traditional advertising entirely.

What's Next

The real test comes in execution. Protocol adoption alone doesn't guarantee success—retailers must optimize their product data, inventory systems, and fulfillment operations to work seamlessly with AI agents. Wayfair's scale and existing Google Cloud relationship provide advantages, but execution risk remains.

Investors should monitor quarterly earnings for signs of improved conversion rates and customer acquisition efficiency. If Wayfair can demonstrate that agentic commerce drives meaningful margin expansion, the stock's current momentum could be justified. If integration challenges emerge, the narrative reverses quickly.

The home goods e-commerce sector has finally found its AI inflection point. Wayfair's early positioning in this shift explains the market's enthusiasm—and sets the stage for a competitive scramble among retailers to adopt the protocol before it becomes mandatory.