Bank of America Elevates Nvidia, Palantir, and Robinhood as Top Stock Picks

Bank of America has identified three high-conviction stock selections: Nvidia, Palantir, and Robinhood. The analysis reflects confidence in AI infrastructure, enterprise software, and fintech innovation as key growth drivers in the current market environment.

Bank of America's Strategic Stock Selections Signal Confidence in AI and Fintech

Bank of America has identified Nvidia, Palantir, and Robinhood as its primary stock selections, reflecting the firm's conviction in three distinct but complementary investment themes: artificial intelligence infrastructure, enterprise AI software, and retail financial technology innovation.

The selection underscores a strategic positioning around secular growth trends that Bank of America analysts believe will drive market outperformance. Each company represents a different layer of the AI and technology ecosystem, from semiconductor manufacturing to data analytics platforms to consumer-facing trading applications.

Nvidia: The AI Infrastructure Play

Nvidia remains the cornerstone of Bank of America's technology thesis. The semiconductor giant continues to dominate the GPU market, which serves as the foundational compute layer for AI model training and deployment. The company's data center business has emerged as a primary revenue driver, with sustained demand from cloud providers and enterprise customers building out AI infrastructure.

Bank of America's confidence in Nvidia reflects:

- Sustained demand for high-performance computing chips as AI adoption accelerates across industries

- Market leadership in GPU technology with limited direct competition at scale

- Revenue diversification beyond gaming into enterprise and cloud segments

- Pricing power driven by the criticality of its products to AI development

Palantir: Enterprise AI Software at Scale

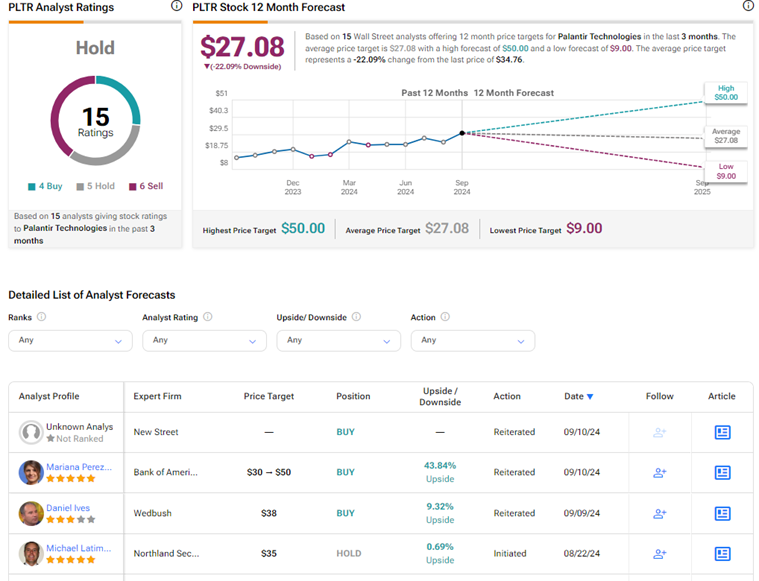

Palantir Technologies represents Bank of America's conviction in enterprise-grade AI software and data analytics. The company has positioned itself as a critical infrastructure provider for organizations seeking to leverage AI for operational intelligence and decision-making.

Bank of America's analysis highlights Palantir's:

- Expanding customer base across commercial and government sectors

- AI-driven product roadmap that enhances platform capabilities and customer stickiness

- Recurring revenue model through software licensing and managed services

- Competitive moat built on proprietary data integration and analytics capabilities

The firm's elevation of Palantir reflects confidence that enterprise demand for AI-powered analytics will sustain growth momentum.

Robinhood: Fintech Democratization

Robinhood Markets completes Bank of America's trio by capturing the retail financial technology narrative. The platform has evolved from a commission-free trading disruptor to a comprehensive financial services provider, expanding into options trading, cryptocurrency, and wealth management tools.

Bank of America's selection of Robinhood indicates:

- User growth and engagement metrics supporting platform expansion

- Revenue diversification beyond trading commissions into higher-margin services

- Market positioning as a leading retail investment platform

- Regulatory tailwinds supporting fintech innovation in retail investing

Technical and Fundamental Alignment

The three selections share common characteristics that likely influenced Bank of America's analysis:

Growth Trajectory: All three companies operate in high-growth markets with secular tailwinds rather than cyclical exposure.

Market Leadership: Each holds a defensible competitive position within its respective segment.

Valuation Discipline: Bank of America's selection suggests the firm believes valuations are justified by growth prospects and competitive positioning.

Macro Resilience: The portfolio reflects exposure to structural trends—AI adoption, enterprise digitalization, and retail financial inclusion—that transcend traditional economic cycles.

Investment Implications

Bank of America's identification of these three stocks provides a framework for understanding the firm's view on technology sector dynamics. The selections suggest confidence that AI-driven productivity gains will support sustained corporate spending on infrastructure and software, while consumer adoption of fintech platforms will continue reshaping retail finance.

Investors should note that Bank of America's selections represent the firm's conviction view but do not constitute individual investment recommendations. Each stock carries distinct risk factors related to valuation, competitive dynamics, and macroeconomic sensitivity.

Key Sources

- Bank of America Equity Research: Technology and Fintech sector analysis

- Company filings and earnings reports for Nvidia, Palantir, and Robinhood Markets

- Market data and analyst consensus from major financial platforms