Nvidia's 2027 Robotaxi Gambit: The Race for Autonomous Dominance Intensifies

Nvidia's entry into the robotaxi space by 2027 signals a major shift in how the AI chipmaker is monetizing its autonomous vehicle technology. The move puts it in direct competition with Tesla and traditional automakers racing to deploy self-driving fleets.

The Autonomous Vehicle Arms Race Heats Up

The battle for robotaxi supremacy just got more crowded. According to recent reports, Nvidia is targeting 2027 as the launch date for its own robotaxi service, marking a significant escalation in the company's ambitions beyond chip manufacturing. This move transforms Nvidia from a critical infrastructure provider into a direct competitor in the autonomous mobility market—a space already crowded with Tesla, Waymo, and traditional automotive players.

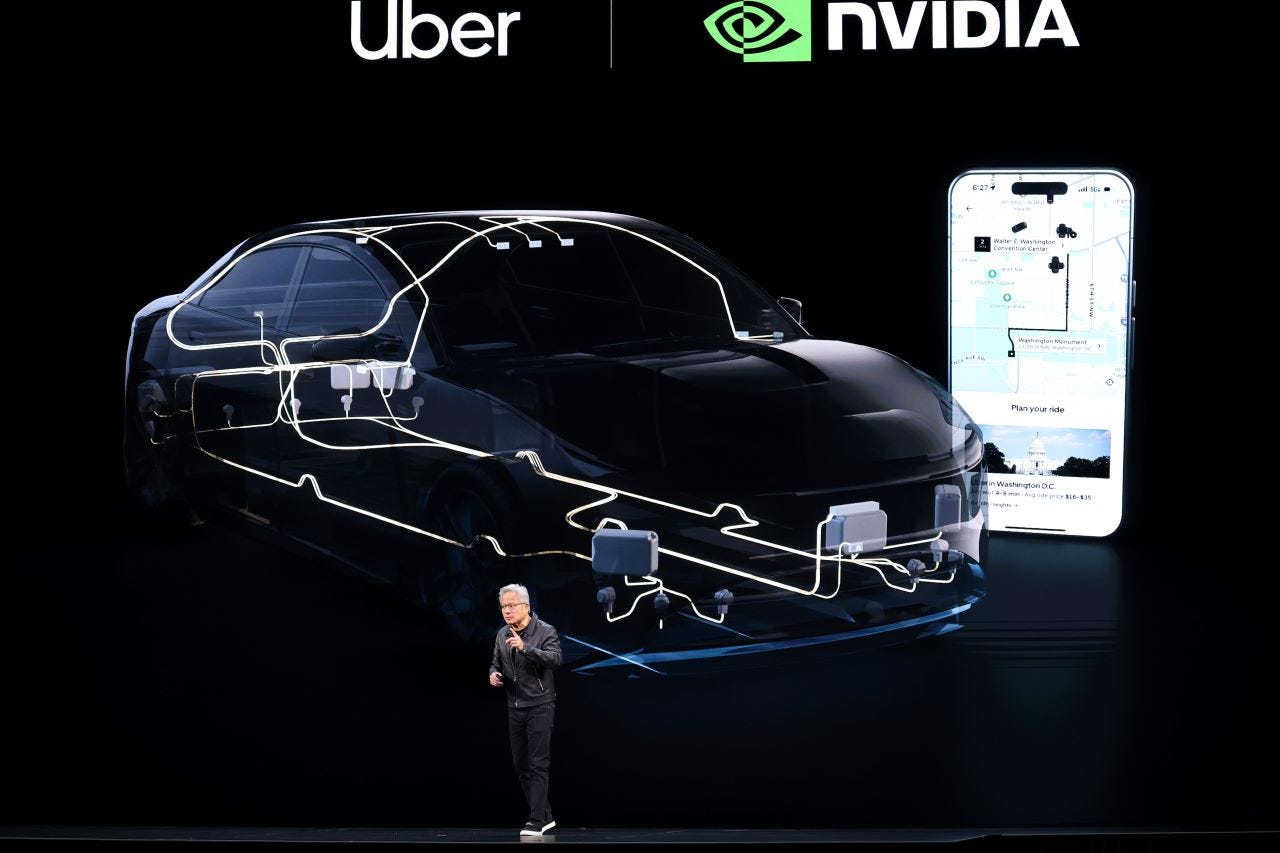

The timing is deliberate. By 2027, Nvidia will have had years to refine its DRIVE platform, accumulate real-world data, and establish partnerships with fleet operators. The company isn't simply building chips anymore; it's building an entire autonomous ecosystem.

Nvidia's Autonomous Vehicle Architecture

Nvidia's robotaxi strategy rests on several technical pillars:

- DRIVE Hyperion Platform: A production-ready autonomous vehicle computing architecture that handles perception, planning, and control

- AI and Deep Learning: Leveraging GPU acceleration for real-time processing of sensor data from cameras, lidar, and radar

- End-to-End Learning: Training neural networks on massive datasets to improve decision-making in complex driving scenarios

- Safety Redundancy: Multiple layers of fail-safes and validation systems to meet Level 4 autonomy standards

The company has been quietly building this infrastructure for years, positioning itself as the backbone of autonomous vehicles across multiple manufacturers. Now, it's ready to showcase what that technology can do when deployed at scale.

The Competitive Landscape

Nvidia's 2027 target puts it in a race with established players. Tesla has been operating its Full Self-Driving beta for years, though regulatory approval for true Level 4 robotaxi operations remains elusive. Waymo has already deployed robotaxis in limited markets. Traditional automakers like GM and BMW are investing heavily in autonomous capabilities.

What sets Nvidia apart is its dual advantage: it controls the chips powering many competitors' vehicles and it's now building its own service. This creates potential conflicts of interest but also gives Nvidia unparalleled insight into what works and what doesn't in autonomous systems.

The Business Model Question

The robotaxi service represents a fundamental shift in Nvidia's revenue model. Rather than selling chips to automakers and fleet operators, Nvidia would capture the higher-margin service revenue from actual rides. This is more lucrative but also more risky—Nvidia would be responsible for safety, liability, and customer experience.

The company's partnership strategy will be crucial. Whether Nvidia operates robotaxis independently or through partnerships with mobility platforms remains unclear, but the 2027 timeline suggests significant capital investment and operational infrastructure buildout.

Regulatory and Technical Hurdles Ahead

Reaching Level 4 autonomy—where vehicles can operate without human intervention in most conditions—requires solving multiple challenges:

- Regulatory Approval: Each jurisdiction has different standards for autonomous vehicle deployment

- Edge Cases: Handling rare, unpredictable driving scenarios that training data may not cover

- Liability Frameworks: Determining responsibility when autonomous vehicles are involved in accidents

- Public Trust: Building consumer confidence in driverless technology

Nvidia's timeline is aggressive but not impossible. The company has the technical expertise, capital resources, and industry relationships to execute. However, the robotaxi market has a history of overpromised timelines and delayed launches.

What's at Stake

Nvidia's robotaxi ambitions signal that the company sees autonomous mobility as a multi-trillion-dollar opportunity. Success would cement Nvidia's position as not just a chip supplier but a mobility platform operator. Failure could distract from its core GPU business and expose the company to operational and liability risks it hasn't previously faced.

The 2027 deadline is less a guarantee and more a marker of intent. Nvidia is betting that its AI infrastructure, computing power, and technical depth can translate into a viable robotaxi service. Whether that bet pays off will define the next chapter of autonomous vehicle development.