Nvidia Reports Record Revenue Amid AI Market Growth

Nvidia reports record revenue, driven by AI demand, amid bubble concerns. Investors weigh growth potential against high valuation multiples.

Nvidia Reports Record Revenue Amid AI Market Growth

Nvidia’s stock has surged significantly, reflecting the company's potential to capture a substantial portion of the burgeoning AI economy. However, this growth is accompanied by concerns about a potential market bubble, as valuation multiples remain high despite ongoing revenue growth and product momentum.

Background

- What happened: Nvidia reported record fiscal results in 2025, with $57.0 billion in revenue for the third quarter of fiscal 2026, marking a 62% year-over-year increase and a 22% sequential rise. This growth is driven by strong demand for data-center GPUs and AI cloud compute capacity.

- Why it matters: These results underscore Nvidia’s central role in the infrastructure of generative AI and large-scale model training. CEO Jensen Huang highlighted accelerating compute demand across training and inference, with cloud GPUs sold out, indicating persistent demand for Nvidia’s products.

Key Developments and Financial Context

- Revenue and Product Drivers: Nvidia’s Blackwell architecture is a major factor in the surge in sales, with cloud providers and enterprises competing for capacity to train and run models. Nvidia is also expanding into software and model tooling, providing a more stable revenue stream beyond hardware sales.

- Capital Returns and Balance Sheet: In the first nine months of fiscal 2026, Nvidia returned $37.0 billion to shareholders through buybacks and dividends. This reflects management confidence and contributes to positive stock performance.

- Market Pricing and Forecasts: Analysts continue to publish optimistic forecasts for Nvidia, citing its current performance and potential future dominance in AI compute. However, some warn of bubble-like conditions due to high price/earnings multiples.

Bubble Concerns vs. Structural Growth Thesis

- Bubble Argument: Critics highlight stretched multiples and rapid appreciation as signs of a potential bubble, which could burst if adoption slows or competition increases.

- Counterpoint — Demand Fundamentals and TAM: Supporters argue that Nvidia benefits from genuine demand for AI compute, with forecasts suggesting a multi-trillion-dollar AI market. Nvidia’s diversification into AI software is seen as a move towards higher-margin, recurring revenue streams.

Industry and Competitive Context

- Competition and Constraints: Nvidia faces competition from other GPU vendors, potential export control limits, and technological challenges as AI workloads grow.

- Ecosystem Effects: Nvidia’s leadership has created a robust ecosystem that supports demand for its products, reinforcing its market position.

Implications for Investors and Markets

- What Investors are Watching: Key indicators include Nvidia’s future guidance, AI software adoption rates, cloud capacity, competitor cycles, and regulatory developments.

- Risk/Return Framing: Investors must balance Nvidia’s growth potential against high expectations. A slowdown in growth or margin compression could lead to a valuation reset.

Visuals and Imagery

- Official Nvidia logo and CEO Jensen Huang’s portrait.

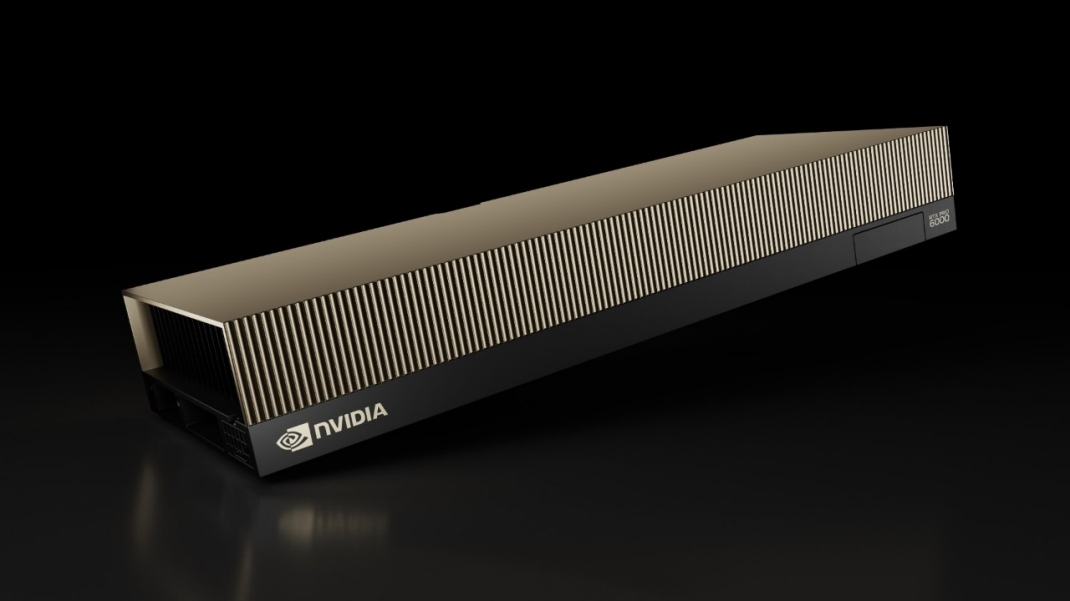

- Product imagery of Nvidia’s Blackwell GPU boards.

- Screenshots of Nvidia’s fiscal results headlines.

- A chart of Nvidia’s share price over the last 24 months.

Context and Outlook

Nvidia is positioned at the forefront of the AI compute demand boom. While its recent performance supports its role as a key player in AI infrastructure, the debate over its stock valuation continues. Investors must monitor execution, competition, and regulatory risks closely.

(Images recommended: Nvidia corporate logo; Jensen Huang portrait; Blackwell GPU product photos; Nvidia investor-relations Q3 FY2026 press release graphic.)