Smart Ring Shipments Surge 49% as CES Unveils New Generation of Wearables

The smart ring market is experiencing explosive growth, with shipments jumping 49% following new device launches at CES 2026. We analyze what's driving adoption and which players are reshaping the wearable landscape.

The Smart Ring Boom Is Real—And It's Accelerating

The wearable technology market just witnessed a significant inflection point. Smart ring shipments have surged 49% following the introduction of new devices at CES 2026, signaling that the finger-worn form factor has moved beyond niche adoption into mainstream territory. This growth trajectory reflects a fundamental shift in how consumers approach health tracking and personal data collection—moving away from bulky smartwatches toward discrete, always-on devices that fit literally on your finger.

According to health technology analysis, the smart ring category has emerged as one of the fastest-growing segments at CES 2026, with manufacturers competing aggressively to capture market share in what was once a fragmented, experimental space. The 49% shipment increase isn't just a statistical blip—it represents genuine consumer demand for a new class of wearables.

Why Smart Rings Are Winning the Form Factor War

Several factors explain this explosive growth:

- Discretion and Comfort: Unlike smartwatches, rings don't require daily charging in many cases and remain invisible during professional settings or formal events

- Continuous Health Monitoring: Modern smart rings track heart rate variability, sleep patterns, stress levels, and activity metrics without the battery drain of larger devices

- Accessibility: Lower price points compared to premium smartwatches make them attractive entry points into the wearables ecosystem

- Fashion Integration: New designs at CES demonstrate that smart rings can function as actual jewelry, not just tech accessories

The broader CES 2026 narrative emphasizes that wearable technology is undergoing a design revolution. Manufacturers are moving beyond the "tech-first" approach, where functionality dominated aesthetics, toward genuinely hybrid products that balance capability with style.

Market Dynamics and Competitive Pressure

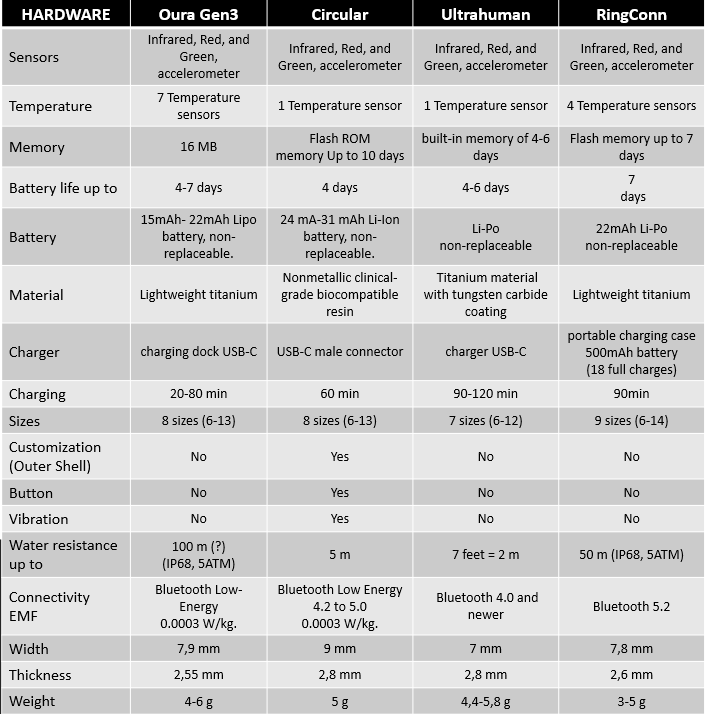

The 49% shipment increase reflects intensifying competition among established players and new entrants. Companies like Oura, RingConn, and others are launching devices with improved sensors, longer battery life, and more sophisticated AI-driven health insights. The CES announcements suggest that manufacturers are addressing previous pain points—particularly around accuracy, battery longevity, and software integration.

This growth also indicates that the smart ring market is transitioning from early adopter phase to early majority adoption. When shipments increase this dramatically, it typically signals that:

- Consumer awareness has reached critical mass

- Price points have become more competitive

- Use cases have become clearer and more compelling

- Distribution channels have expanded beyond specialty retailers

What's Next for Smart Ring Innovation

The devices unveiled at CES 2026 point toward several emerging trends:

- Advanced Biometric Sensing: Next-generation rings are incorporating more sophisticated sensors for blood oxygen, temperature, and potentially glucose monitoring

- AI-Powered Insights: Machine learning algorithms are becoming more sophisticated at interpreting raw biometric data into actionable health recommendations

- Ecosystem Integration: Smart rings are increasingly designed to work seamlessly with smartphones, fitness platforms, and healthcare applications

- Extended Battery Life: New power management techniques are pushing battery life toward weeks rather than days

The Broader Implications

A 49% surge in smart ring shipments matters beyond the wearables industry. It signals consumer appetite for less intrusive, more integrated health monitoring technology. As privacy concerns around data collection persist, the shift toward personal wearables—devices you own and control directly—represents a meaningful countertrend to cloud-dependent health platforms.

The smart ring market's momentum also validates a design philosophy that prioritizes form factor innovation alongside technical capability. In an era of smartphone saturation, wearables represent one of the few genuinely novel product categories, and smart rings exemplify how constraint (limited screen space, minimal power budget) can drive creative engineering solutions.

The CES 2026 announcements suggest this growth trajectory will continue, at least through the near term. Whether smart rings ultimately displace smartwatches or occupy a complementary niche remains an open question—but the 49% shipment increase indicates the market has already made its initial verdict.